Global Imports of Goods & New Export orders PMI

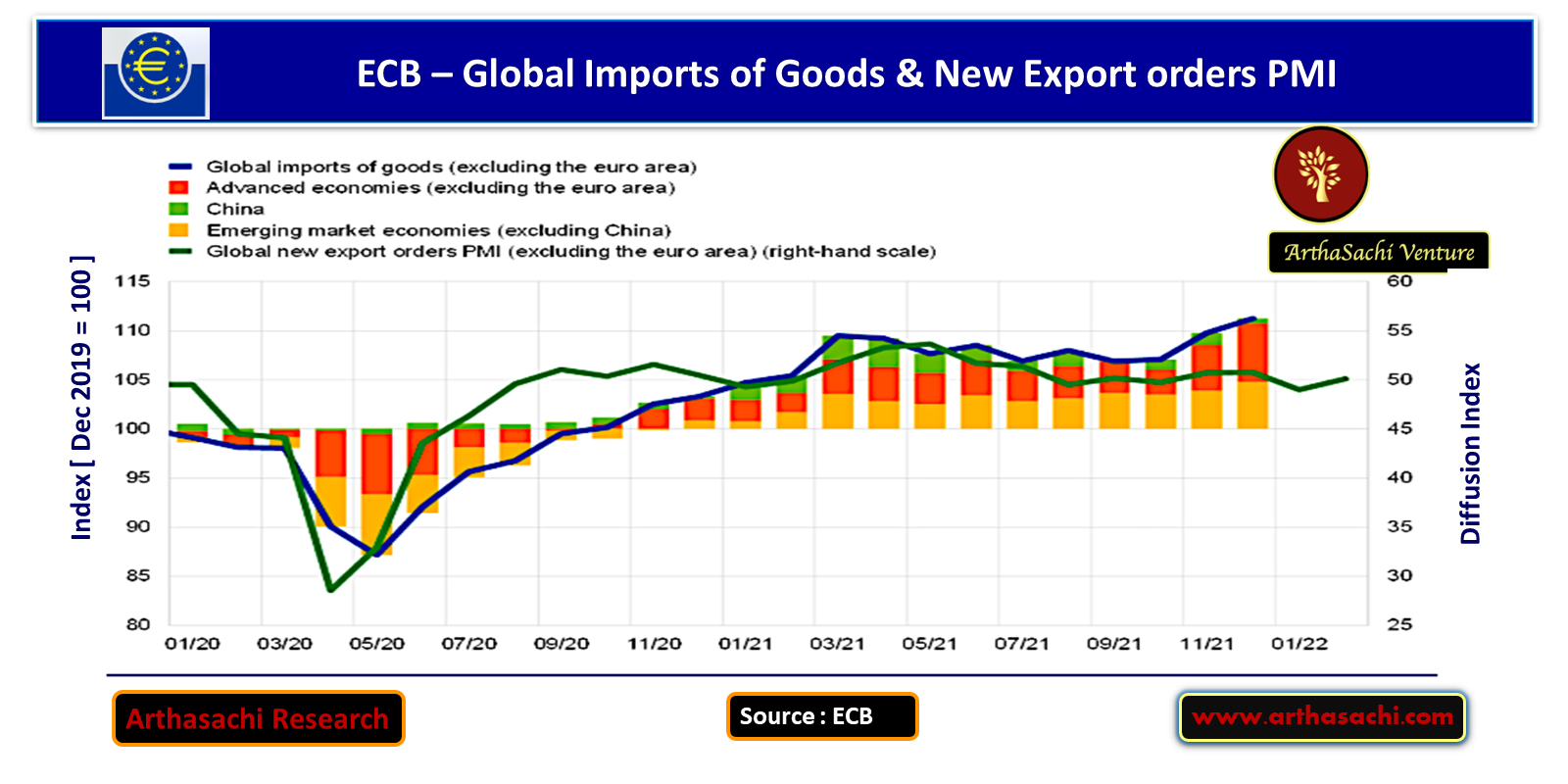

Global trade (excluding the euro area) grew robustly in 2021, supported by strong demand for goods, notwithstanding supply chain disruptions.

Global trade proved stronger than expected in the second half of 2021, driven by a robust performance in emerging Asia and, in the fourth quarter, the United States. Strains in global production networks continue to be felt in the shipping sector in particular, where prices remain elevated. By contrast, the recovery in global car production points to some easing of semiconductor shortages in recent months. Compared with the December 2021 Eurosystem staff macroeconomic projections, global import growth (excluding the euro area) for 2021 has been revised up by 1 percentage point to 12.1%.

Incoming high frequency indicators point to subdued trade growth at the turn of the year, although this is expected to be temporary.

Between December and January, services trade (as reflected in the weekly indicators for hotel bookings and numbers of flights) declined as the pandemic intensified. This volatility proved only temporary, as concerns about the severity of the pandemic new variant’s impact started to dissipate. For the first quarter of 2022, high frequency data point to continued trade growth stemming from strong demand, in particular for steel and tech products, and somewhat less disruptive bottlenecks. Taiwan’s export orders, a global bellwether of global technology demand, have risen sharply since mid-2021 and reached record highs in November. Steel production recovered strongly towards the end of 2021 after a sharp contraction in the third quarter amid a slowdown in China’s real estate sector. This strong recovery is expected to have continued in early 2022.