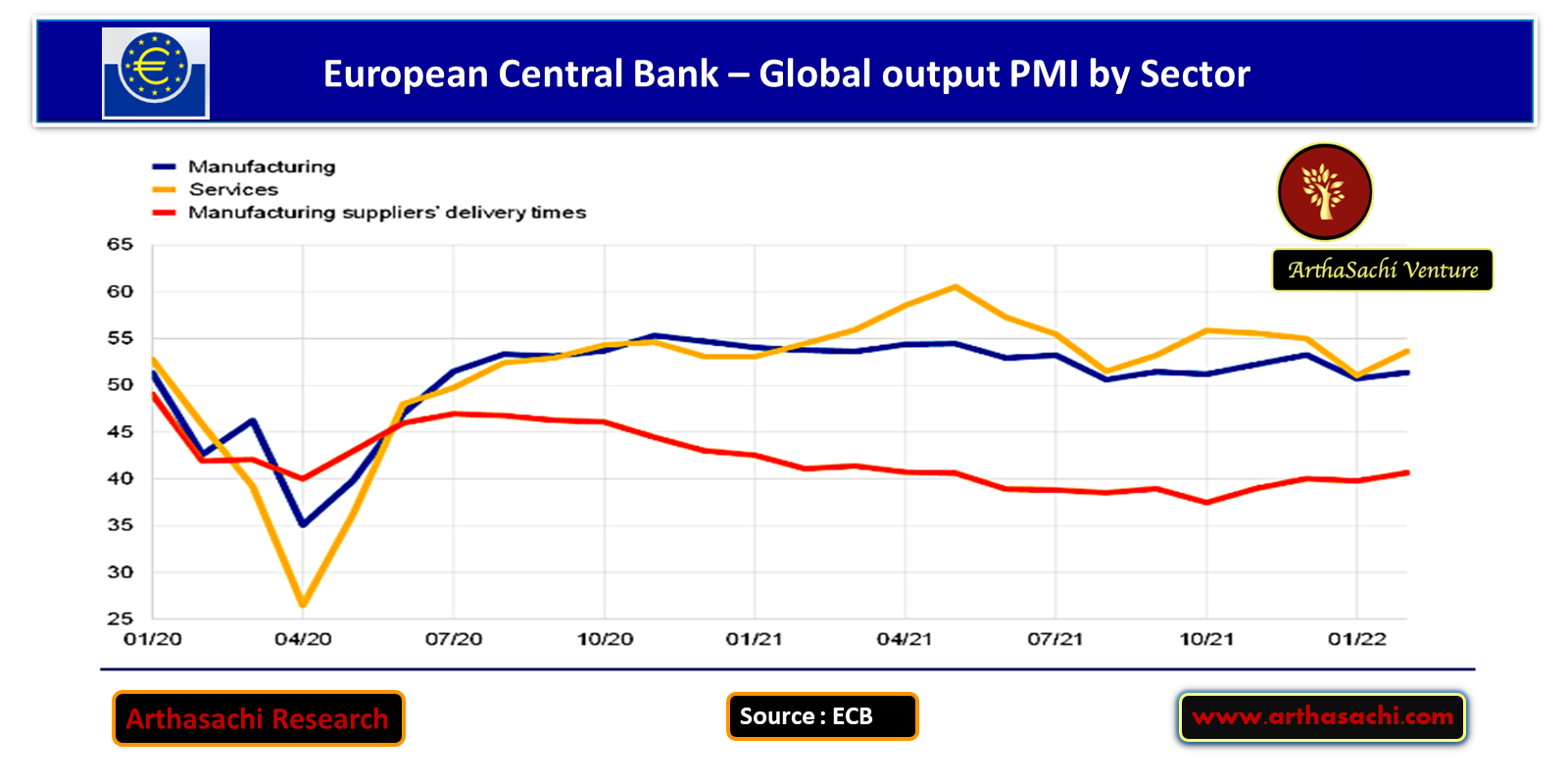

Global output PMI by Sector

In February the global composite PMI index (excluding the euro area) rose to 53.1 from 51 in January, driven mainly by the services sector, which rebounded from a decline at the turn of the year induced by the spread of the pandemic new variant. The global manufacturing output PMI also increased but to a lesser extent, signalling positive albeit moderate growth. Overall, the economic impact of the pandemic new variant is expected to be moderate and limited to the first quarter of 2022. Nevertheless, the emergence of novel and more aggressive variants of the virus cannot be ruled out and pandemic remains a downside risk to the global economy. Compared with the December 2021 Euro-system staff macroeconomic projections, global real GDP growth (excluding the euro area) for the first quarter of 2022 has been revised down by 0.7 percentage points, to 0.5% quarter on quarter, largely on account of the impact of the pandemic variant. The global suppliers’ delivery times PMI (excluding the euro area) has been improving slightly of late but remains tight and still points to long delivery times, while congestion in ocean shipping remains elevated. At the same time, given strong growth in merchandise trade and car production in recent months, it appears that supply constraints in some sectors might have passed their peak. Overall, the March 2022 ECB staff macroeconomic projections continue to assume that supply bottlenecks will gradually start to ease over the course of 2022 and to fully unwind by 2023. This will happen as consumer demand rotates back from goods to services and shipping capacity and semiconductor supply increase on the back of planned investment.

The geo-political escalation has sent jitters through the global economy and is assessed to weigh on the global outlook via three main channels. First, the substantial financial and (non-energy) trade sanctions being imposed on Russia will severely affect economic activity and trade in the country over the projection horizon. The exclusion of some Russian banks from SWIFT translates into more extensive disruptions, also affecting global trade, by severely impairing trade financing for Russian firms. Second, the conflict has put significant upward pressure on commodity prices, as Russia plays a major role in EU energy markets, while Ukraine is a top exporter of food commodities – mostly cereals – to the EU.

Commodity prices had already been significantly affected by rising geopolitical tensions throughout 2021. Finally, the escalation in the geopolitical tensions is hurting global confidence, inducing negative effects on both the financial and the real economy sides. The ensuing worsening of financial conditions, together with sustained geopolitical tensions and uncertainty, is expected in turn to affect investment.