Case Study: AI is Revolutionizing Financial Research & Wealth Management space

Introduction

The financial research landscape is undergoing a seismic shift, driven by the power of artificial intelligence (AI). At Arthasachi Venture, we are at the forefront of this transformation, leveraging our AI-First Approach to redefine how wealth management and financial research are conducted. Our innovative AI AGENT is not just a tool—it’s a game-changer, setting a new benchmark for precision, efficiency, and intelligent decision-making in the wealth management space. This case study explores how Arthasachi Venture is pushing the boundaries of financial research and preparing for a future where AI drives the industry.

The Challenge: Traditional Financial Research Limitations

Traditional financial research is labor-intensive, time-consuming, and prone to human error. Analysts manually sift through company filings, earnings reports, and market data, often struggling to keep pace with the sheer volume of information. In the fast-moving world of wealth management, delays in processing data or generating insights can mean missed opportunities for investors. Arthasachi Venture recognized these challenges and sought to harness AI to revolutionize the process, making it faster, more accurate, and scalable.

The Solution: Arthasachi’s AI AGENT

At the heart of our AI-First Approach is the Arthasachi AI AGENT—a sophisticated system designed to streamline and enhance every aspect of financial research. Built on cutting-edge AI models and customized for the wealth management domain, the AI AGENT automates repetitive tasks, uncovers deep insights, and delivers actionable intelligence with unprecedented speed.

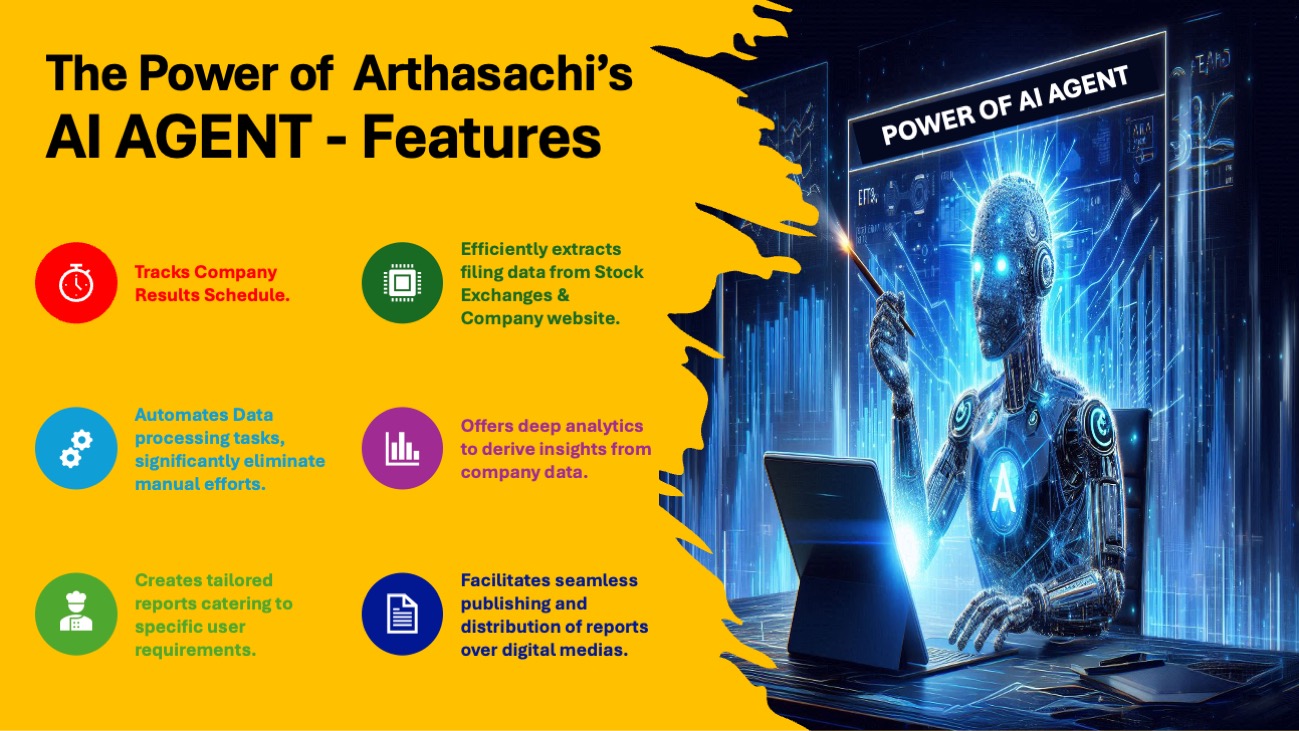

Key Features of the AI AGENT:

- Tracks Company Schedules: Maintains an up-to-date record of companies and their scheduled earnings release dates, ensuring no critical updates are missed.

- Extracts Filing Data: Pulls structured and unstructured data directly from stock exchanges or company websites, eliminating manual data collection.

- Automates Data Processing: Processes financial data—balance sheets, income statements, and cash flows—in real time, reducing turnaround time from days to hours.

- In-Depth Analysis: Conducts comprehensive analysis of financial results, identifying trends, anomalies, and key performance indicators.

- Generates Reports: Produces detailed company reports tailored to the needs of wealth managers and investors.

- Writes Insightful Articles: Crafts engaging, data-driven articles highlighting financial trends and market shifts.

- Expert Oversight: Undergoes rigorous review by Senior Research Analysts to ensure accuracy and quality.

- Seamless Publishing: Automates the publication of reports and articles to our website and mobile apps (Arthasachi Venture Wealth), available on Apple App Store and Google Play Store.

By integrating these capabilities, the AI AGENT transforms raw data into actionable insights, empowering wealth managers to make informed decisions faster than ever before.

The Implementation: Testing and Results

Over the past few months, Arthasachi Venture has rigorously tested the AI AGENT using multiple advanced language models, including OpenAI, xAI’s Grok, DeepSeek AI, and Alibaba’s Qwen. The focus was on real-world applicability, with the AI AGENT tasked with analyzing a diverse set of companies, such as NVIDIA, Sun Pharma, LIC, SBI, and CIPLA.

Key Outcomes:

- Speed: What once took days—analyzing quarterly results and drafting reports—now takes mere hours.

- Accuracy: AI-driven data extraction and analysis reduced errors by over 90% compared to manual processes.

- Insight Depth: The AI AGENT identified trends and correlations (e.g., sector-specific growth drivers) that human analysts initially overlooked.

- Scalability: The system effortlessly handled simultaneous analysis of multiple companies, a feat impossible for traditional research teams without significant resource expansion.

For instance, in analyzing NVIDIA’s latest earnings, the AI AGENT not only processed the financials but also contextualized them against industry benchmarks and GPU market trends, producing a report that was both granular and strategic. Similarly, for Sun Pharma, it highlighted subtle shifts in R & D spending that signaled future growth potential—insights that traditional methods might have missed.

The results were nothing short of astonishing. This wasn’t just automation; it was a paradigm shift in how financial research could be conducted.

Real-World Impact

The deployment of the AI AGENT has had a profound impact on Arthasachi Venture’s operations and the broader wealth management ecosystem:

- Efficiency Gains: Research turnaround time has been slashed, enabling real-time decision-making for clients.

- Cost Reduction: Automation has lowered operational costs, allowing us to pass savings on to investors.

- Competitive Edge: Our AI-driven insights give us a distinct advantage over traditional research houses still reliant on manual processes.

- Client Satisfaction: Wealth managers now have access to richer, timelier data, enhancing their ability to serve clients effectively.

We’re convinced that traditional research houses are on borrowed time. The clock is ticking, and AI AGENTs like ours are poised to replace them entirely or occupy substantial space in the near future.

The Future: AI-Driven Wealth Management

Arthasachi Venture sees the AI AGENT as just the beginning. The future of wealth management lies in fully embracing AI, automation, and personalization. Here’s where we’re headed:

- True AI-Driven Robo Advisors: Moving beyond basic automation to offer AI-first advisory services that adapt to individual client needs.

- Democratization of Wealth Management: Making high-quality financial research and advice accessible to a broader audience, not just the elite.

- Emotional AI & Behavioral Finance: Integrating behavioral data to tailor strategies that align withclients’ emotional and psychological profiles.

- Rebalancing Portfolios with Changing Risk Profiles and Market Conditions: Dynamically adjusting investment portfolios based on real-time shifts in risk tolerance, market volatility, and economic indicators, ensuring optimal performance and alignment with client goals.

These advancements will make wealth management faster, smarter, and more inclusive, leveling the playing field and empowering investors like never before.

The Bottom Line

Arthasachi Venture’s AI-First Approach, powered by the AI AGENT, is not just revolutionizing financial research—it’s redefining the future of wealth management. By combining cutting-edge AI with human expertise, we’re delivering unparalleled value to our clients and setting the stage for a new era of financial intelligence. As research firms evolve into fully AI-powered entities, Arthasachi Venture is leading the charge, proving that the future isn’t coming—it’s already here.

This case study demonstrates how Generative AI, when combined with financial intelligence & data analytics insights, unlocks immense value for businesses, enabling them to build highly intelligent, scalable, and adaptable digital Solution.

Alliances and Partners

Feature Template Block

Arthasachi Venture Footprints