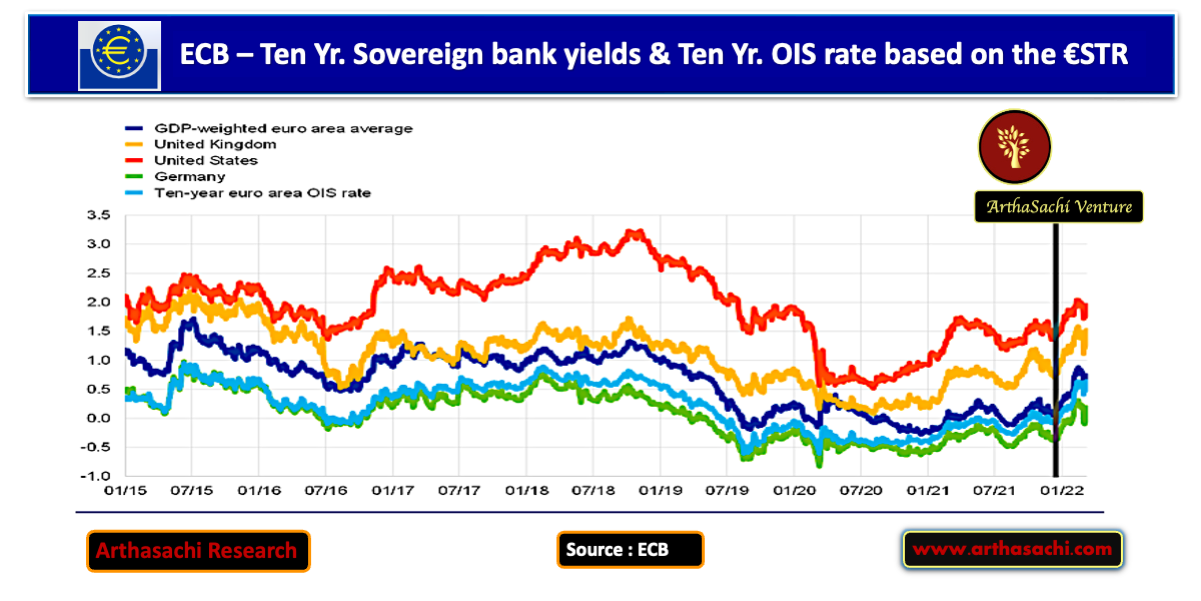

Ten-year sovereign bond yields and the ten-year OIS rate based on the €STR

Long-term average euro area sovereign bond yields increased in line with risk-free rates, reaching levels that were significantly higher than they had been at the start of the review period, despite a transitory drop after the geo-political escalation on 24 February 2022, with partly differing patterns across euro area countries.

Between mid-December and mid-February, sovereign bond yields increased in line with the strong upward trend in longer-term risk-free rates, which also resulted in a steeper sovereign yield curve, reflecting higher inflation compensation amid waning concerns over the pandemic new variant and firmer expectations in respect of monetary policy normalisation. However, sovereign bond yields subsequently dropped in the wake of the geo-political escalation as real rates fell, with some minor flight-to-safety movements but, overall, a broad-based decline across the euro area amid expectations of slower monetary policy normalisation given the economic uncertainties ahead. Over the review period, both the GDP-weighted euro area average ten-year sovereign bond yield and the ten-year risk-free OIS rate based on the €STR increased by approximately 70 basis points, to 0.74% and 0.64% respectively. Similar developments were seen in the United States, where the ten-year sovereign bond yield increased by around 50 basis points, reaching 1.95% at the end of the review period.

Following the December meeting of the Governing Council, there was a marked upward shift in the short end of the €STR forward curve, which accelerated after the February meeting of the Governing Council, suggesting a significant repricing of rate hike expectations by market participants.