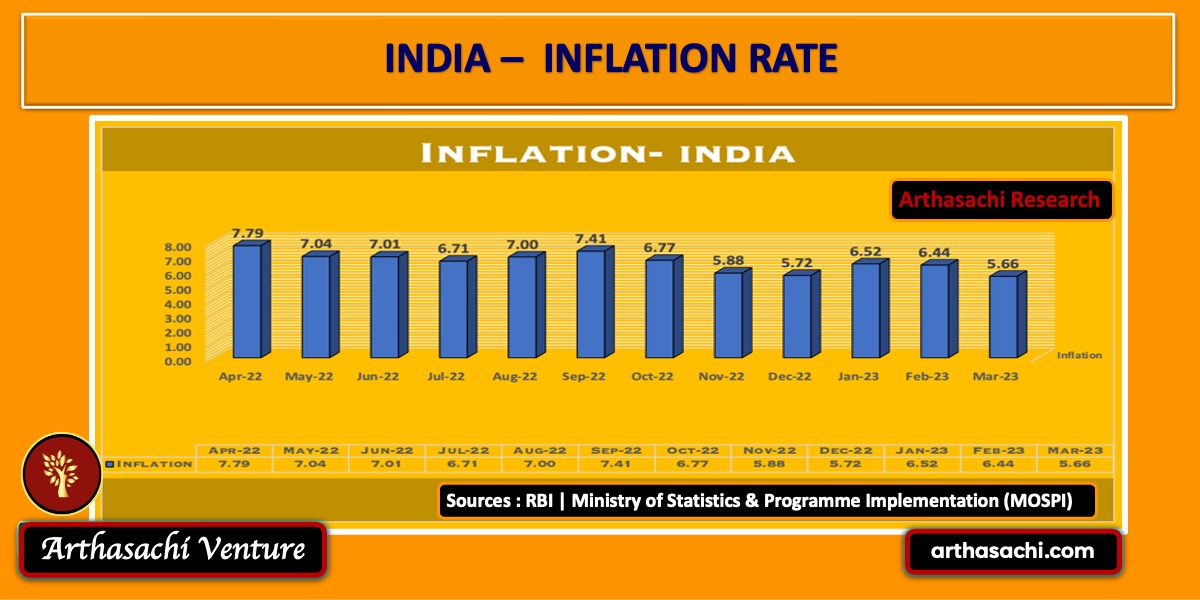

India Inflation rate fall to 5.66% returned to below the RBI upper tolerance limit of 6%

The annual consumer inflation in India for March 2023 exhibited a noteworthy decline to 5.66%, the lowest since December 2021, compared to February's 6.44%.

The figure was slightly below market predictions of 5.8%. This reduction in inflation can be attributed to a deceleration in the costs of food items, especially vegetables (-8.51%), oils and fats (-7.86%), and meat (-1.42%), which partly offset the increased prices of cereals (15.27%), milk (9.3%), and spices (18.21%). Additionally, the cost of sugar and confectionery went up by 1%. Furthermore, there was a slowdown in the cost of fuel and light (8.91% vs 9.9%), miscellaneous (5.77% vs 6.12%), clothing and footwear (8.18% vs 8.8%), and pan, tobacco, and intoxicants (2.99% vs 3.22%). Conversely, housing prices rose at a faster pace (4.96% vs 4.83%).

Notably, the inflation rate returned to below the Reserve Bank of India's upper tolerance limit of 6%. RBI managed the economy so well, unlike other central bank which are still fighting with high inflation rate and raised many doubts on their ability to manage the economy, growth and their ability to bring down the inflation within the tolerance range. Indian Central Bank RBI stand tall and demonstrates its strong position when it took firm stance to pause on rate hike in the backdrop of other central banks such as the Federal Reserve, Bank of England, and European Central Bank have raised their rates. Moreover, the RBI is credited with successfully reducing inflation to levels within the tolerance range set by the bank. Among the top 10 economies worldwide, the RBI remains the only central bank to achieve these remarkable accomplishments.