India’s Robust Economy Fuels Records Highest Growth rate of 15% YoY in November GST Revenue collection

The Exchequer's GST Revenue registered highest growth rate.

The gross Goods and Services Tax (GST) revenue garnered in November 2023 amounted to ₹1,67,929 crore, comprising ₹30,420 crore for the Central Goods and Services Tax (CGST), ₹38,226 crore for the State Goods and Services Tax (SGST), ₹87,009 crore for the Integrated Goods and Services Tax (IGST) (including ₹39,198 crore collected on the importation of goods), and ₹12,274 crore for cess (including ₹1,036 crore collected on the importation of goods).

KEY TAKEAWAY

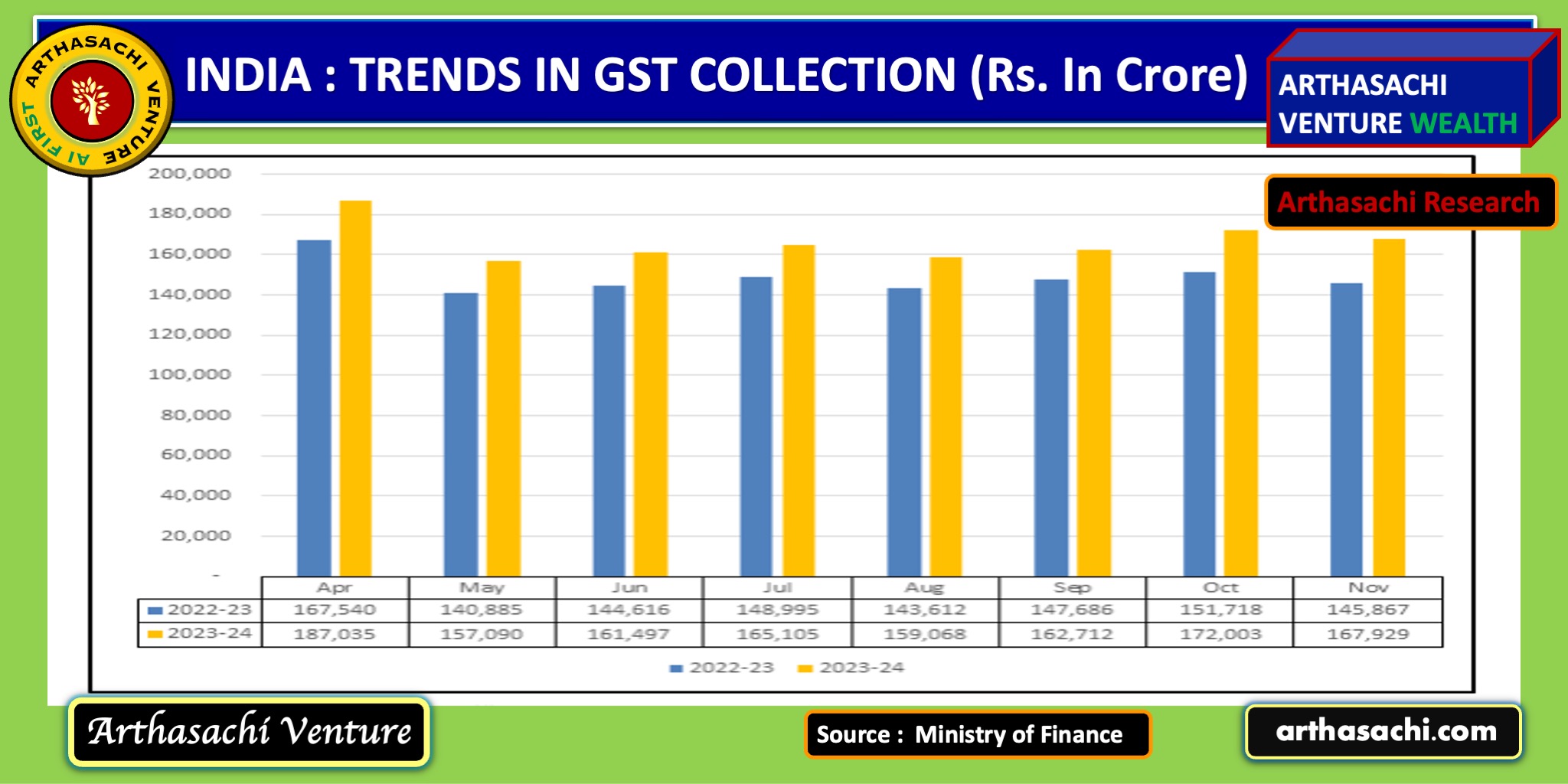

- Gross GST collection crosses ₹1.60 lakh crore mark for the sixth time in FY 2023

- GST collection higher by 11.9% Y-o-Y for FY2023-24 upto November, 2023

- The Total Gross GST collection for 2022-23 stands at ₹18.10 lakh crore and the average gross monthly GST collection for the full year is ₹1.51 lakh crore.

- The Gross Revenues in 2022-23 were 22% higher than that last year.

The Indian government has allocated ₹37,878 crore to the CGST and ₹31,557 crore to the SGST from the IGST. The combined revenue of the central and state governments in November 2023 after regular settlement stands at ₹68,297 crore for the CGST and ₹69,783 crore for the SGST.

The November 2023 revenues represent a 15% increase over the GST revenues collected in the same month last year and are the highest year-on-year monthly revenues recorded during 2023-24, up to November 2023. During the month, revenues from domestic transactions (including the importation of services) were 20% higher than the revenues from these sources during the same month last year. This is the sixth time that gross GST collection has surpassed the ₹1.60 lakh crore mark in FY 2023-24.

The gross GST collection for FY 2023-24 ending November 2023 [₹13,32,440 crore, averaging ₹1.66 lakh per month] is 11.9% higher than the gross GST collection for FY 2022-23 ending November 2022 [₹11,90,920 crore, averaging ₹1.49 lakh crore per month].