Gold’s Glittering Run: Futures Cross the $4,000 Mark Amid Global Turmoil

Gold’s timeless allure has once again captured global attention. For the first time in history, gold futures have crossed the $4,000 per ounce mark, marking a powerful comeback for the precious metal as investors worldwide seek safety amid deepening political and economic uncertainty.

The milestone reflects a perfect storm of factors — from renewed geopolitical tensions and concerns of a US government shutdown, to hopes of more interest rate cuts from the Federal Reserve. Together, these elements have reignited gold’s status as the ultimate safe-haven asset.

According to Arthasachi Intelligence data, December gold futures in New York — the most actively traded contract — surged past $4,000 on Tuesday, while spot gold briefly touched $3,992.27 per ounce. The rally extended gains from the previous session, underscoring a sustained wave of investor confidence in bullion.

India Joins the Gold Rush

Back home, India — one of the world’s largest consumers of gold — mirrored the global excitement. Gold prices traded above ₹1,21,000 per 10 grams, according to the India Bullion & Jewellers Association. The price surge, coming right in the middle of the festive season, has added a glittering twist to traditional buying patterns.

Festive demand typically strengthens during this time of year, but this time, sentiment is being reinforced by rising global prices and a softer rupee, making the yellow metal even more precious for Indian households and investors alike.

Why Gold Is Shining Brighter Than Ever

So, what’s driving this record-breaking rally? The answer lies in a mix of global anxiety, shifting monetary policies, and changing investment behavior.

- Safe-Haven Demand: With the US government once again staring down a potential shutdown, investors are fleeing to gold for protection against uncertainty.

- Rate Cut Expectations: Hopes for additional Federal Reserve rate cuts have increased the appeal of gold, which thrives when interest rates fall.

- Central Bank Buying: Central banks across the world continue to accumulate gold reserves, signaling long-term confidence in its value.

- Investment Inflows: According to the World Gold Council, September saw the strongest-ever monthly inflows into gold-backed ETFs, showing how retail and institutional investors are piling into the metal.

A Year of Historic Gains

Gold has already soared more than 50% this year, making 2025 one of its most spectacular years in decades. Analysts point out that this is the biggest annual gain since 1979, when geopolitical shocks and inflation fears last drove similar momentum.

President Donald Trump’s ongoing trade realignments and geopolitical maneuvers have added further fuel to the rally, as markets remain on edge over the global economic outlook.

Beyond the Numbers: What Lies Ahead

For investors, gold’s surge beyond $4,000 is more than a headline — it’s a signal. In a world grappling with shifting alliances, volatile markets, and fragile growth, gold remains the universal hedge against instability.

While some profit-taking could cool prices in the short term, most analysts believe the long-term trend remains firmly bullish. With central banks maintaining dovish stances and inflationary pressures lingering, the yellow metal may continue to glitter well into 2025.

In times of chaos, one truth remains eternal — when uncertainty reigns, gold reigns supreme.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

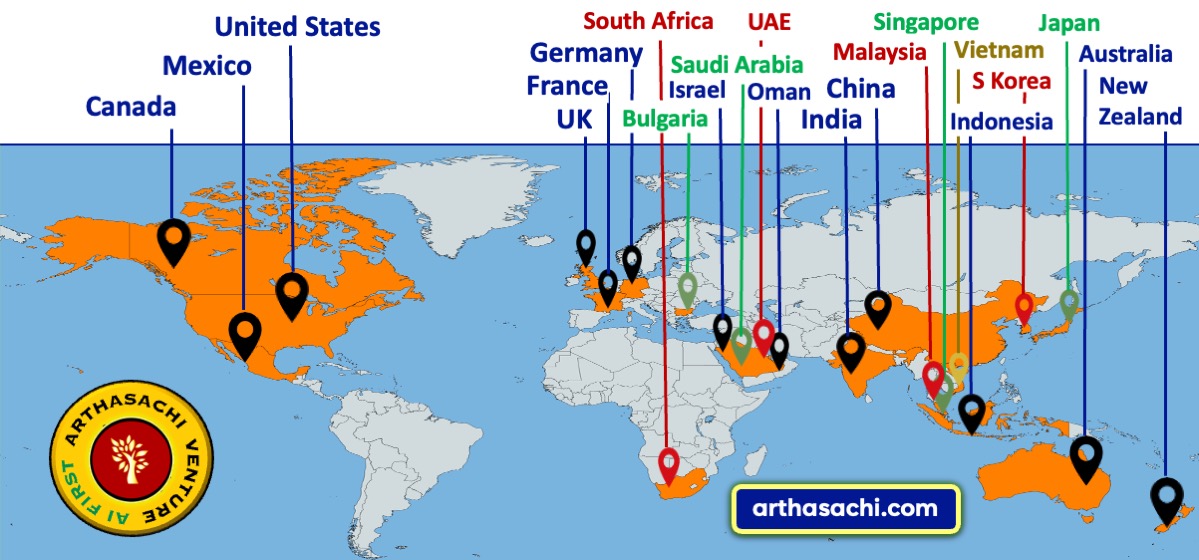

Alliances and Partners

Arthasachi Venture Footprints