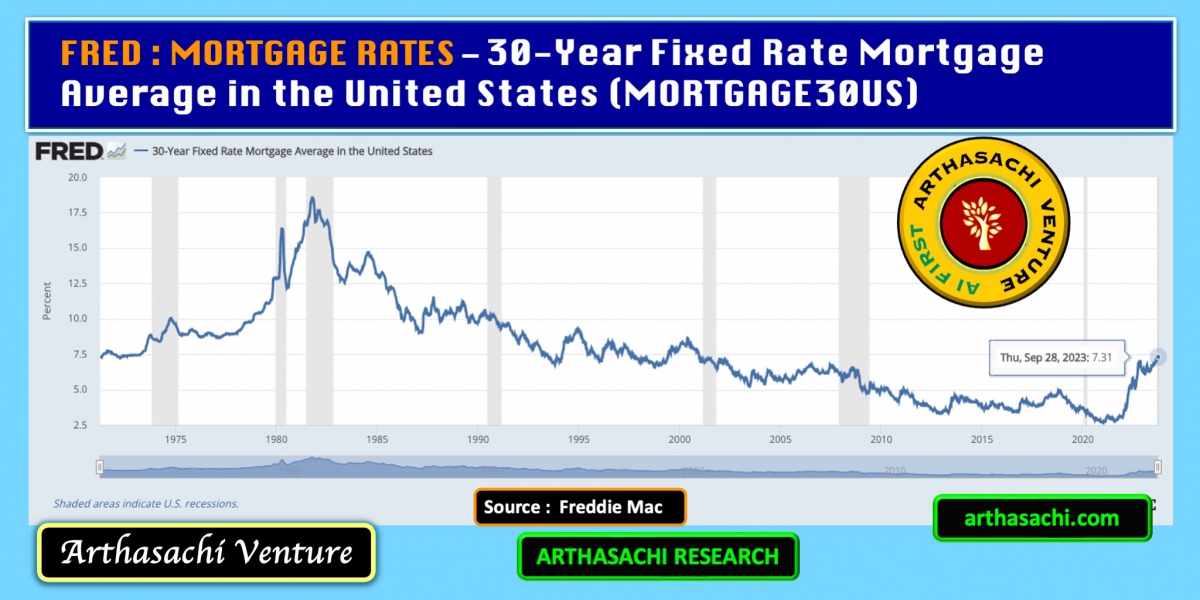

US 30-Year Mortgage Rates Soar to 7.31% - A Historic High Since December 2000

According to a recent survey, the interest rate pertaining to the most popular residential mortgage in the United States experienced a significant uptick last week, reaching its highest level since December 2000. This surge in interest rates played a pivotal role in precipitating a notable decline in mortgage applications, which have now reached their lowest point in 28 years.

As elucidated by the Mortgage Bankers Association, the average contractual interest rate for a 30-year fixed-rate mortgage soared to an imposing 7.31% during the week concluding on September 28th. This surge was catalyzed by the yields on government bonds, which exert considerable influence on home-loan rates, surging to levels not witnessed since the tumultuous financial crisis of 2007-2009.

Throughout the summer, yields on Treasury securities have continued their relentless ascent, driven by unexpectedly robust economic data. This, in turn, has prompted a recalibration of investors' expectations regarding the duration for which the Federal Reserve will maintain high interest rates. The Federal Reserve, in an effort to combat the most formidable bout of inflation since the 1980s, has incrementally raised its benchmark policy rate from nearly zero in March 2022 to its current range of 5.25% to 5.50%. During its September 2023 meeting, the Federal Reserve opted to maintain the target range for the federal funds rate at the elevated level of 5.25% to 5.5%, a rate unseen for 22 years, following a 25bps hike in July. This decision aligned with the predictions of the financial markets. However, the central bank hinted at the possibility of yet another rate increase within the same year.

In a broader context, characterised by a slowdown in the economy boasting a robust job market and vigorous consumer spending, the housing sector has emerged as the segment most profoundly impacted by the Federal Reserve's assertive measures aimed at curbing demand and curbing inflation.

As the cost of borrowing experienced an abrupt ascent, home sales witnessed a protracted decline throughout the preceding year, and any hopes for a recovery in the current year remain unfulfilled. A glaring example of this downturn is the fact that sales of pre-owned homes, which constitute the majority of residential real estate transactions in the United States, have fallen for the second consecutive month in July, plummeting to their lowest levels since January.

The data provided by the Mortgage Bankers Association does not augur well for imminent improvements. Their index gauging applications for mortgages for home purchases plummeted by 5% during the previous week, marking its lowest point since April 1995. This decline stands as the most substantial weekly drop since April.

Furthermore, the data from the MBA underscores the lack of enthusiasm for refinancing existing loans, which has now slumped to levels not seen since December 2000. The primary reason for this decline is the fact that the vast majority of homeowners with existing mortgages acquired their loans prior to the surge in interest rates that commenced in 2022. This circumstance acts as a disincentive for homeowners to contemplate relocating, thereby contributing to the prevailing scarcity in the housing supply.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints