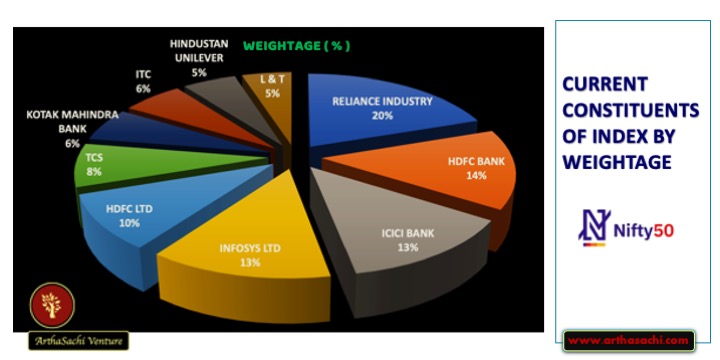

Current Constituent of INDEX - NIFTY50 by WEIGHTAGE

The NIFTY 50 is a diversified 50 stock index accounting for 13 sectors of the economy. It is used for a variety of purposes such as benchmarking fund portfolios, index based derivatives and index funds.

NIFTY 50 is owned and managed by NSE Indices Limited (formerly known as India Index Services & Products Limited) (NSE Indices). NSE Indices is India's specialised company focused upon the index as a core product.

- The NIFTY 50 Index represents about 66.8% of the free float market capitalization of the stocks listed on NSE as on March 29, 2019.

- The total traded value of NIFTY 50 index constituents for the last six months ending March 2019 is approximately 53.4% of the traded value of all stocks on the NSE.

- Impact cost of the NIFTY 50 for a portfolio size of Rs.50 lakhs is 0.02% for the month March 2019..

- NIFTY 50 is ideal for derivatives trading.

INDEX METHODOLOGY

Eligibility Criteria for Selection of Constituent Stocks:

- Market impact cost is the best measure of the liquidity of a stock. It accurately reflects the costs faced when actually trading an index. For a stock to qualify for possible inclusion into the NIFTY50, have traded at an average impact cost of 0.50% or less during the last six months for 90% of the observations, for the basket size of Rs. 100 Million.

- The company should have a listing history of 6 months.

- Companies that are allowed to trade in F&O segment are only eligible to be constituent of the index.

- A company which comes out with an IPO will be eligible for inclusion in the index, if it fulfills the normal eligibility criteria for the index for a 3 month period instead of a 6 month period.

Index Re-Balancing:

Index is re-balanced on semi-annual basis. The cut-off date is January 31 and July 31 of each year, i.e. For semi-annual review of indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to market from the date of change.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.