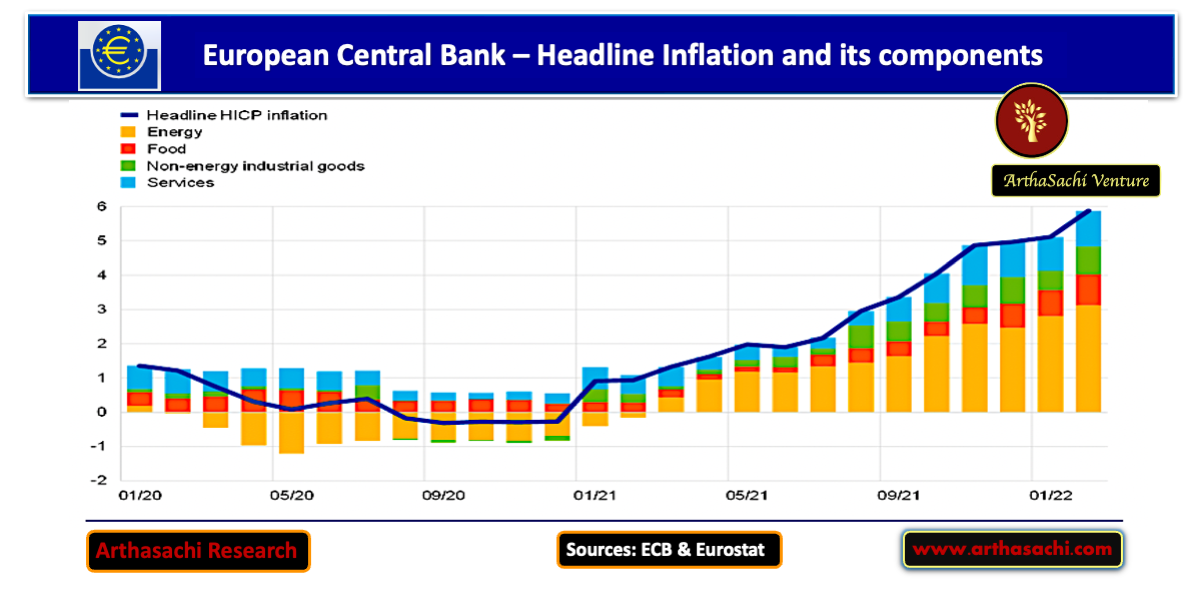

Headline Inflation and its components

The headline HICP remains the appropriate index for quantifying the price stability objective for the euro area and will be retained as the price index used to measure euro area inflation for monetary policy purposes.

The assessment of the suitability of the HICP is based on four criteria: timeliness; reliability (e.g. infrequent revisions); comparability (over time and across countries); and credibility.

Inflation increased to a record 7.5 percent in March, from 5.9 percent in February. Higher Energy price remain the biggest contributor which stand 45 precent above their level one year ago. As per ECB estimates Energy prices will stay high in the near term. Food prices have also increased sharply, due to elevated transportation, production cost and price of fertilisers. Supply bottlenecks and the normalisation of demand due to reopening of the economy is also putting pressure on prices.

Energy Inflation which reached 31.7 percent in February, continues to be the main reason for the high overall rate of inflation and is pushing up prices across many other sectors.

In March 2022 staff macro-economic projections foresee annual inflation at 5.1 percent in 2022, 2.1 percent in 2023 and 1.9 percent in 2024 substantially higher than in the previous projection in December.

The path for the key ECB interest rates will continue to be determined by the Governing Council’s forward guidance and by its strategic commitment to stabilise inflation at 2% over the medium term.