Drivers of Change in EURO Area Government Debts

Compared with the December 2021 Eurosystem staff macroeconomic projections, the budget balance at the end of the projection horizon has been revised slightly downwards.

The most significant annual revision concerns a more favourable budget balance estimate for 2021. Specifically, for 2021 the euro area general government budget balance as a share of GDP has been revised up by 0.5 percentage points to -5.5% of GDP, primarily on account of a higher-than-expected cyclically adjusted primary balance. Despite this improvement, the budget balance has been revised upwards only marginally by 0.1 percentage points for 2022, while it is left unchanged for 2023 and revised downwards by 0.2 percentage points for 2024. The downward revision of the budget balance at the end of the forecast horizon in the baseline stems from the deterioration in the macroeconomic outlook triggered by the geopolitical escalation in the region and the upward revisions of interest payments as a share of GDP.

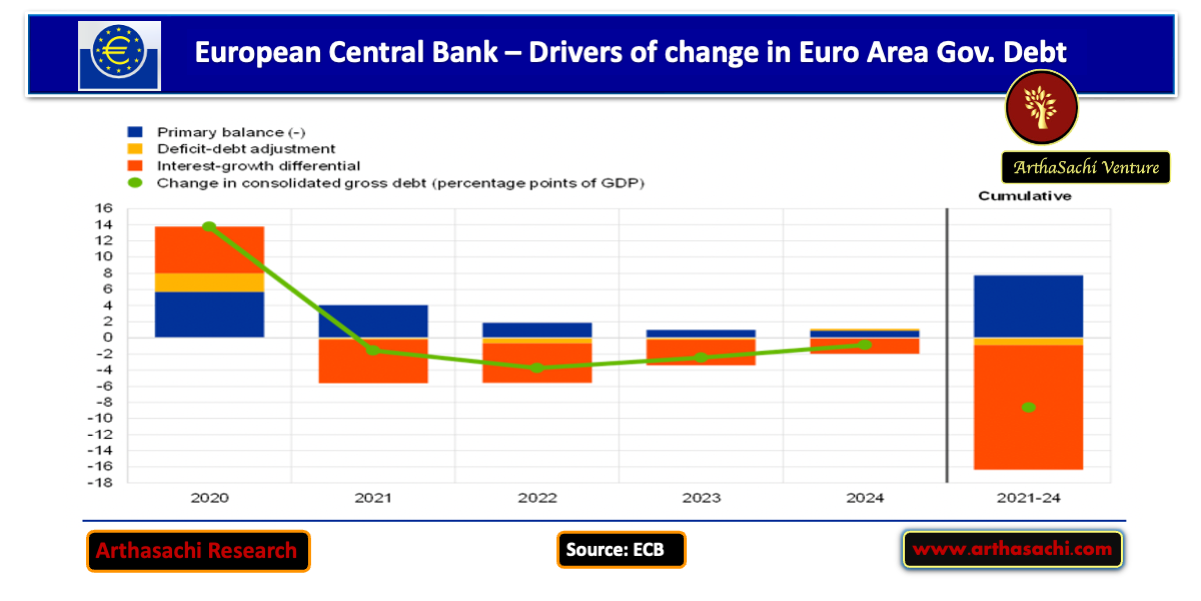

Following a large increase in 2020, the euro area government debt-to-GDP ratio is estimated to have declined slightly to around 96% in 2021 and is expected to shrink further to 89% in 2024.

After an increase of close to 14 percentage points in the debt ratio in 2020, a falling but still high primary deficit in 2021 is estimated to have been more than offset by a significant debt-reducing contribution from the interest-growth differential. In 2022 and 2023 the debt ratio is projected to decline more quickly as debt-increasing primary deficits, although falling, are outweighed by favourable contributions from interest-growth differentials and, to a lesser extent, by negative deficit-debt adjustments. At the end of the projection horizon in 2024, the debt-to-GDP ratio is expected to fall to just below 89%, 5 percentage points above its pre-crisis level in 2019. Overall, the pandemic crisis has had a significantly smaller adverse impact on the euro area aggregate debt path than was generally expected in the initial phase of the crisis.

Risks to this fiscal baseline are, however, substantial and increasingly tilted towards larger budget deficits.