HDFC Bank Reports Robust Q1FY26 registered a Net Revenue growth of 31% on YoY

HDFC Bank Q1 FY26 Earnings Arthasachi indepth coverage

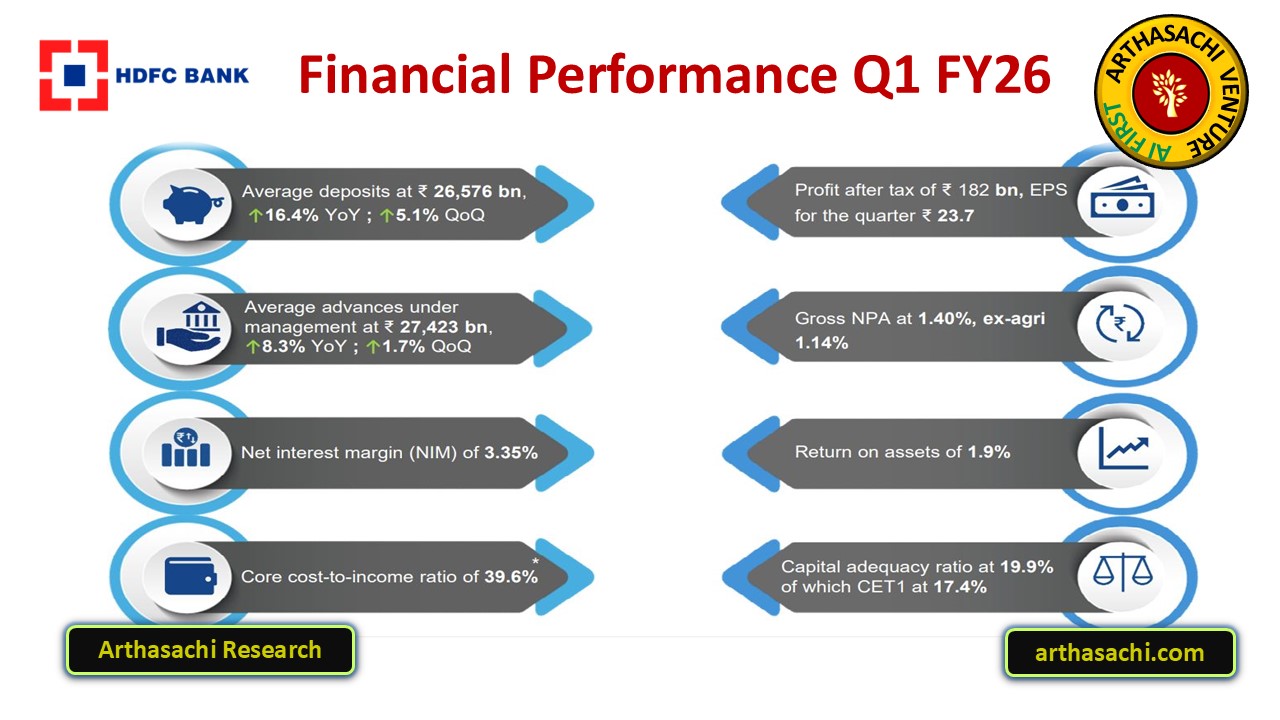

Key Financial Highlight

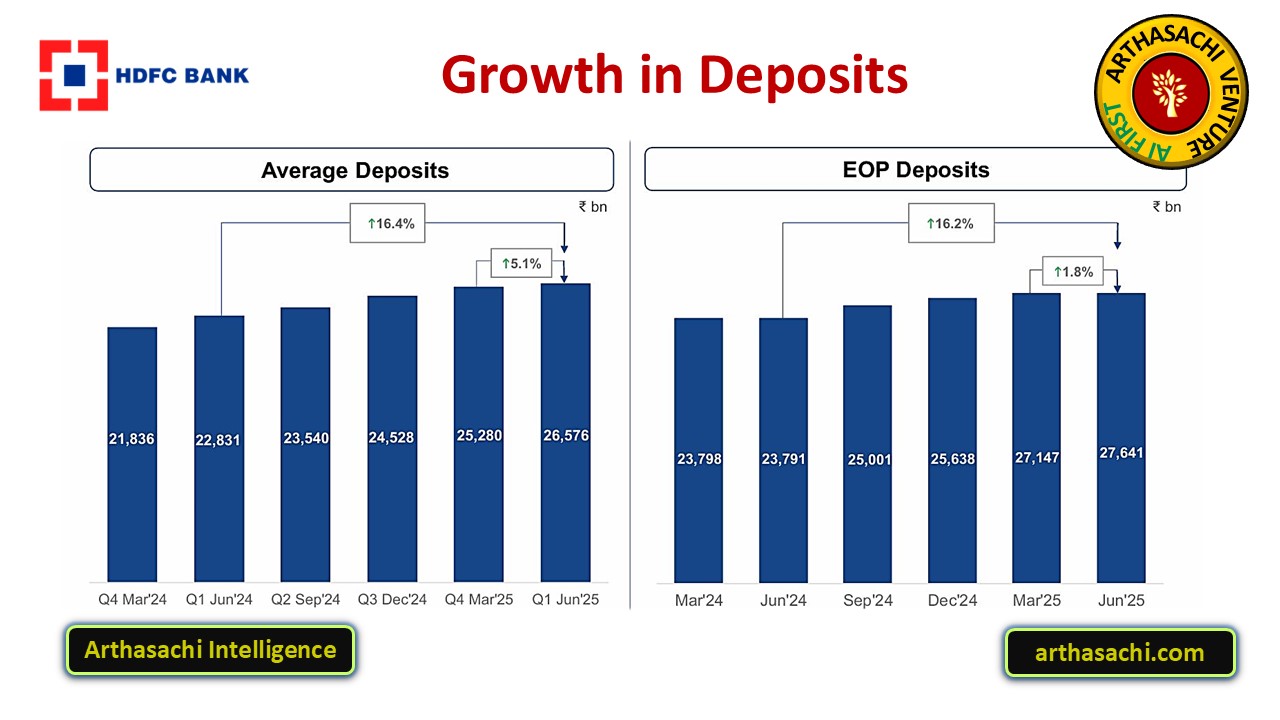

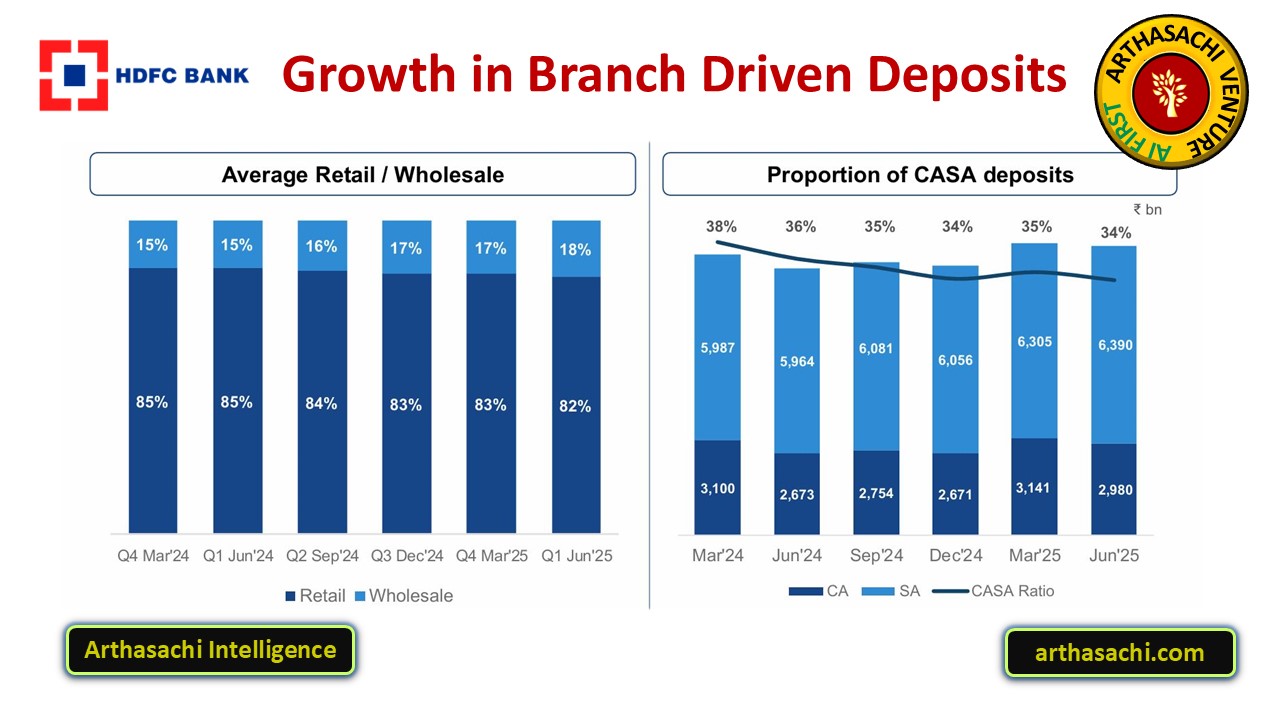

- Strong deposit growth: Average deposits grew by 16.4% YoY and 5.1% QoQ, reflecting robust franchise strength and customer trust.

- Advances and AUM: Advances under management increased by 8.3% YoY (1.7% QoQ), while Gross Advances rose 6.7% YoY, supported by retail and SME segments.

- Profitability: Quarterly Profit After Tax reached ₹182 billion, with EPS at ₹23.7.

- Sustained margins: Net Interest Margin (NIM) stood at 3.35%; operating metrics remain resilient.

- Strong capital position: Capital Adequacy Ratio at 19.9%, CET1 at 17.4%.

- Asset quality: Gross NPA ratio remained stable at 1.40% (ex-agri at 1.14%), indicating effective risk management.

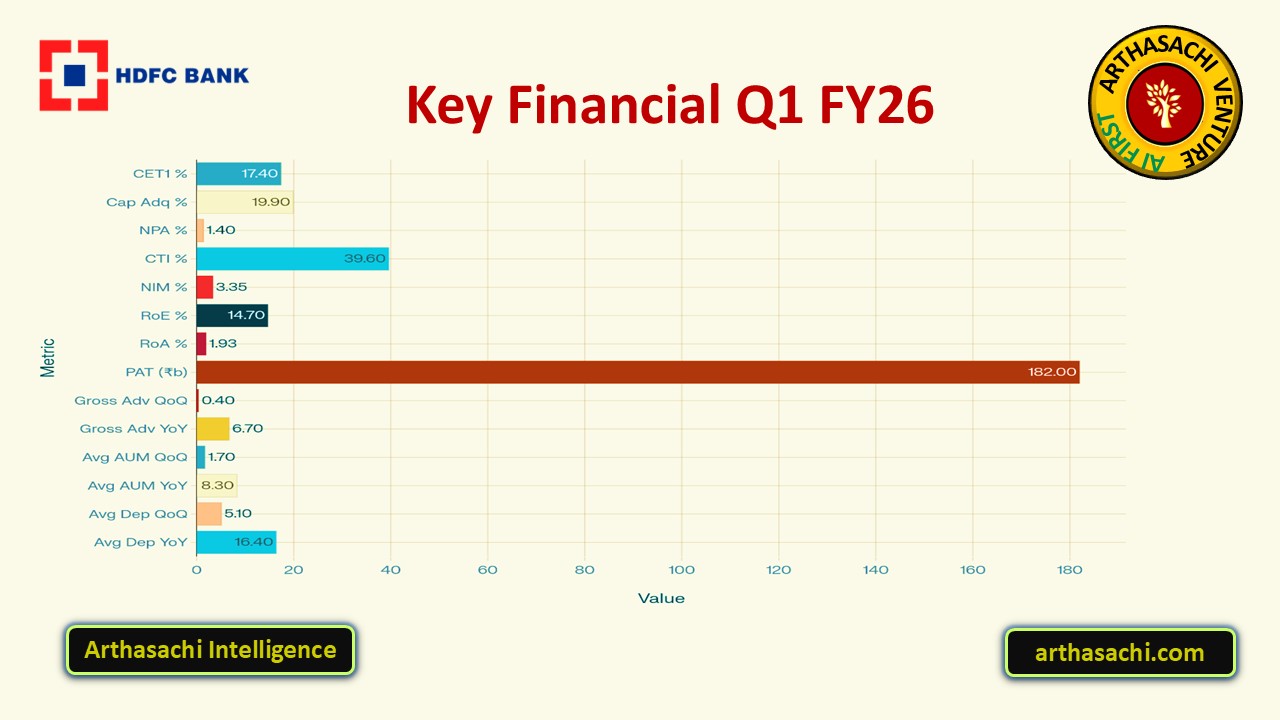

Key ratios and growth metrics are visually summarized below:

Detailed Performance Review

Business Growth

|

Metric |

Q1 FY26 |

YoY Change |

QoQ Change |

|

Average Deposits (₹ bn) |

26,576

|

+16.4% |

+5.1% |

|

Average AUM (₹ bn) |

27,423 |

+8.3% |

+1.7% |

|

Gross Advances (₹ bn) |

26,532 |

+6.7% |

+0.4% |

|

Profit After Tax (₹ bn) |

182 |

+12.2% |

+3.1% |

Profitability and Efficiency

- Net Interest Margin (NIM): 3.35%

- Cost-to-Income Ratio: 39.6% (improved due to higher revenue and disciplined cost management)

- Return on Assets (RoA): 1.93%

- Return on Equity (RoE): 14.7%

Asset Quality & Capital

- Gross NPA ratio: 1.40%

- Net NPA ratio: 0.4%

- Provision Coverage Ratio: 71%

- Capital Adequacy Ratio: 19.9% (well above regulatory requirements)

- CET1 Ratio: 17.4%

Segmental Trends

- Retail advances maintained strength, with mortgages as the largest component and business banking driving SME growth.

- Wholesale advances share remained steady, with balance sheet diversification and prudent underwriting.

- Fee and commission income grew robustly, while non-interest income jumped 103.7% YoY, partly due to one-off transaction gains.

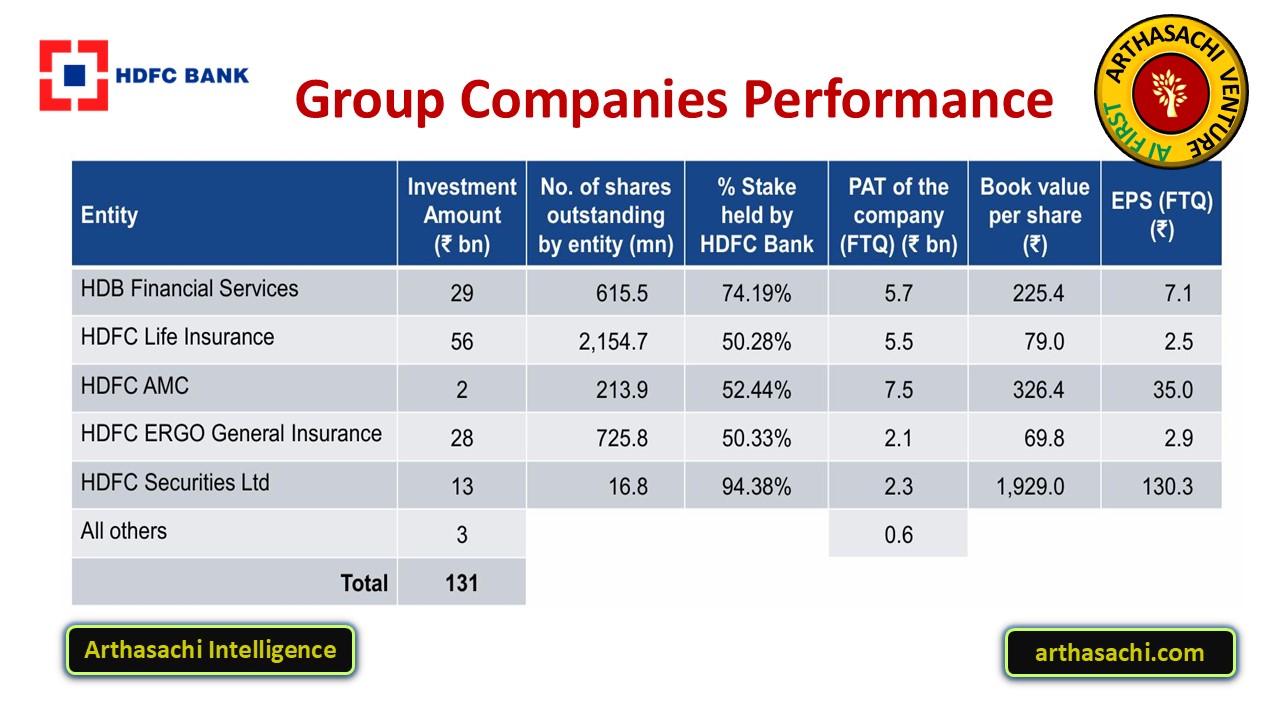

Subsidiary and Group Performance

- HDB Financial Services: Loan book up 14.3% YoY to ₹1,093 bn, net profit of ₹5.7 bn, strong operational metrics.

- HDFC Life Insurance: Premium income up 16% YoY, PAT at ₹5.5 bn, continued market leadership.

- HDFC AMC: AUM at ₹8.3 tn, net profit ₹7.5 bn.

- HDFC Securities Ltd: Serviced 7.1 million customers, digital platforms driving engagement.

ESG and Strategic Direction

- ESG score of 80/100 (low ESG risk, S&P 85th percentile).

- Sustainable finance: 18.7% of loan book.

- Carbon neutrality target: FY32.

Investor Perspective

- HDFC Bank’s Q1 FY26 results reaffirm its market leadership in growth, profitability, asset quality, and capital strength.

- The bank’s focus on core operating metrics, prudent risk controls, and digital/service franchise expansion positions it well for consistent compounding.

- Management commentary emphasizes balancing growth with conservative credit practices and innovation in customer offerings.

Overall, HDFC Bank continues to deliver resilient financial performance and create long-term value for investors through robust fundamentals and forward-looking strategy.

GROUP COMPANIES

What does the 16.4% YoY growth in deposits indicate about HDFC Bank's customer confidence

The 16.4% year-on-year (YoY) growth in deposits at HDFC Bank powerfully signals rising customer confidence and trust in the bank’s stability and value proposition.

This robust deposit growth—outpacing the overall industry trend and the bank’s advance growth—implies that a large number of customers, both retail and institutional, are actively choosing HDFC Bank as their primary destination for saving and investment. Key factors supporting this confidence include the bank’s enduring reputation for operational strength, strong risk management, and consistent delivery of returns, even in a competitive and fast-evolving financial market. The continued preference for time deposits (which surged 22.1% YoY) further indicates that customers feel secure entrusting their longer-term funds to HDFC Bank, reflecting optimism in its ability to offer safety alongside competitive returns.

Overall, such a steep rise in deposits provides HDFC Bank with ample low-cost capital to fund asset growth, signals healthy franchise expansion, and is often viewed by investors as a clear marker of financial resilience and top-tier customer satisfaction, reinforcing the bank’s reputation as a preferred institution in the Indian banking sector.

How might the QoQ increase in average deposits and AUM impact HDFC Bank's future profitability

A quarter-on-quarter (QoQ) increase in average deposits and assets under management (AUM) typically has a positive impact on HDFC Bank's future profitability. Here's how this trend benefits the bank, supported by recent data and sector analysis:

1. Strengthens Low-Cost Funding Base

- Higher average deposits—especially when time deposits and CASA deposits rise sequentially—provide the bank with a larger pool of relatively low-cost funds. This enables HDFC Bank to fund more loans without over-relying on higher-cost market borrowings, which can help maintain or improve net interest margins (NIMs).

- The bank saw a QoQ deposit growth of 3.1% and a similar rise in AUM, reflecting strong franchise strength and customer confidence.

2. Ability to Accelerate Loan Growth

- With an expanding deposit and AUM base, HDFC Bank is better positioned to ramp up loan disbursal in subsequent quarters—either to individuals, SMEs, or corporates—when credit demand recovers. The bank’s management has stated it now has ample liquidity and capital to support accelerated loan growth as macroeconomic conditions become more favourable.

- Improving the loan-to-deposit ratio (LDR) gives the bank flexibility to lend more while managing liquidity prudently.

3. Operating Leverage and Earnings Stability

- Growing deposits and AUM provide the bank with more balance sheet heft to generate interest income and fee-based revenues from investment and wealth management products.

- This helps offset periods when margins may come under pressure, such as in a soft interest rate environment, ensuring earnings resilience and stability even if loan growth is temporarily muted.

Table: Impact of QoQ Growth in Deposits and AUM

|

Metric |

Q1 FY26 QoQ Growth |

Positive Impact on Profitability |

|

Avg. Deposits |

↑ 5.1% |

Lower funding cost, improved NIM |

|

Total AUM |

↑ 1.7% |

More fee income, higher loan headroom |

|

Loan/Deposit Ratio |

↓ (Improved) |

Greater lending capacity, lower risk |

|

NIM |

Stable/Improved |

Supported by deposit momentum |

In summary:

The QoQ increase in average deposits and AUM positions HDFC Bank to enhance future profitability through a stronger funding base, improved lending potential, and greater operational scale—all while supporting stable margins and robust asset quality. The bank is thus well-placed to capture incremental spreads and revenue as credit growth returns.

Why is the slight decline in CASA deposits significant for HDFC Bank’s liquidity profile

A slight decline in CASA (Current Account Savings Account) deposits is significant for HDFC Bank’s liquidity profile because CASA deposits represent a crucial source of low-cost, highly liquid funding for the bank. Here’s why this matters:

1. Increased Funding Costs:

CASA deposits are typically the cheapest form of funding available to banks because they pay lower interest rates compared to term deposits. When HDFC Bank’s CASA ratio falls (for instance, from 38.2% in March 2024 to 36.3% in June 2024), it means a greater share of its funding must now come from costlier sources like fixed or term deposits. This shift can put upward pressure on the bank’s overall funding costs and squeeze its net interest margin—one of the most critical profitability metrics for a bank.

2. Potential Liquidity Pressure:

CASA deposits provide not just low-cost funding, but also stable and readily-available liquidity. A decline—such as the recent 5% QoQ drop in CASA deposits—could cause HDFC Bank’s liquidity profile to weaken if not offset by strong inflows in other deposit categories or prudent liquidity management. If too many customers move funds from CASA to higher-yielding deposits or alternative financial products (especially in a soft interest rate environment), the bank may need to seek more expensive or less predictable sources of liquidity.

3. Impact on Growth and Flexibility:

A strong CASA base allows the bank to fund loan growth more effectively and at lower cost, supporting its market competitiveness. If CASA shrinks, the resulting higher funding costs may restrict the bank’s ability to underwrite new loans aggressively, or force it to raise lending rates. While HDFC Bank’s overall liquidity coverage ratio has improved (to 123% in Q1), sustaining this depends on maintaining or growing a healthy mix of CASA deposits going forward.

In summary:

Even a slight decline in CASA deposits signals a structural shift that could impact HDFC Bank’s liquidity strength, cost structure, and flexibility in deploying funds. That’s why the trend is closely watched by investors and analysts for its potential downstream effects on margins, risk, and long-term profitability.

How do HDFC Bank’s key ratios like RoA, RoE, and NIM compare to industry benchmarks

HDFC Bank’s key profitability ratios—Return on Assets (RoA), Return on Equity (RoE), and Net Interest Margin (NIM)—consistently outperform most large Indian private and public sector peers, signaling strong operating efficiency and effective capital deployment.

|

Metric |

HDFC Bank (Latest) |

SBI |

ICICI Bank |

Axis Bank |

Industry Private Avg. |

|

RoA |

1.93% |

1.13% |

1.76% |

1.3% |

~1.5% |

|

RoE |

14.7% |

21.8% |

15.2% |

12.8% |

~12–14% |

|

NIM |

3.35–3.78% |

3.18% |

3.0–3.7% |

3.38% |

~3.2–3.5% |

Return on Assets (RoA):

HDFC Bank’s RoA, at 1.93%, is among the highest in the Indian banking industry. This ratio is a clear indicator of how efficiently the bank uses its asset base to generate profit. HDFC’s number surpasses that of SBI (1.13%), ICICI (1.76%), and Axis (1.3%), underlining superior asset utilization and risk management.

Return on Equity (RoE):

With an RoE of 14.7%, HDFC Bank delivers robust returns to its shareholders, in line with or exceeding the private sector average, and just behind SBI’s 21.8% (boosted recently by lower equity base and improved operational leverage). This demonstrates not just profitability but prudent equity management and stable capital usage.

Net Interest Margin (NIM):

HDFC Bank maintains an industry-leading NIM between 3.35% and 3.78% in recent quarters, higher than SBI’s 3.18%, ICICI’s 3.0–3.7%, and broadly comparable to or better than other private banks like Axis. High NIM reflects effective pricing of loans, good deposit mix, and strong credit risk controls—major profit drivers for HDFC Bank.

In summary:

HDFC Bank’s ability to consistently post higher RoA and NIM, with competitive RoE, compared to top industry benchmarks across both public and private peers, highlights its efficient operations, low-cost funding, and resilience—factors that continue to attract investors and underpin its premium valuation within the sector.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints