Oil prices: “$150 a barrel, a real possibility,” says strategist

Oil prices soar on the possible ban on Russian Oil import, Saudi Aramco hikes oil price and decides to continue raising out of Oil gradually.

KEY TAKEAWAYS

- Saudi Aramco hikes oil prices for all the regions to more than $115 a barrel after crude saw a huge spike in the wake of Russia’s Ukraine conflict.

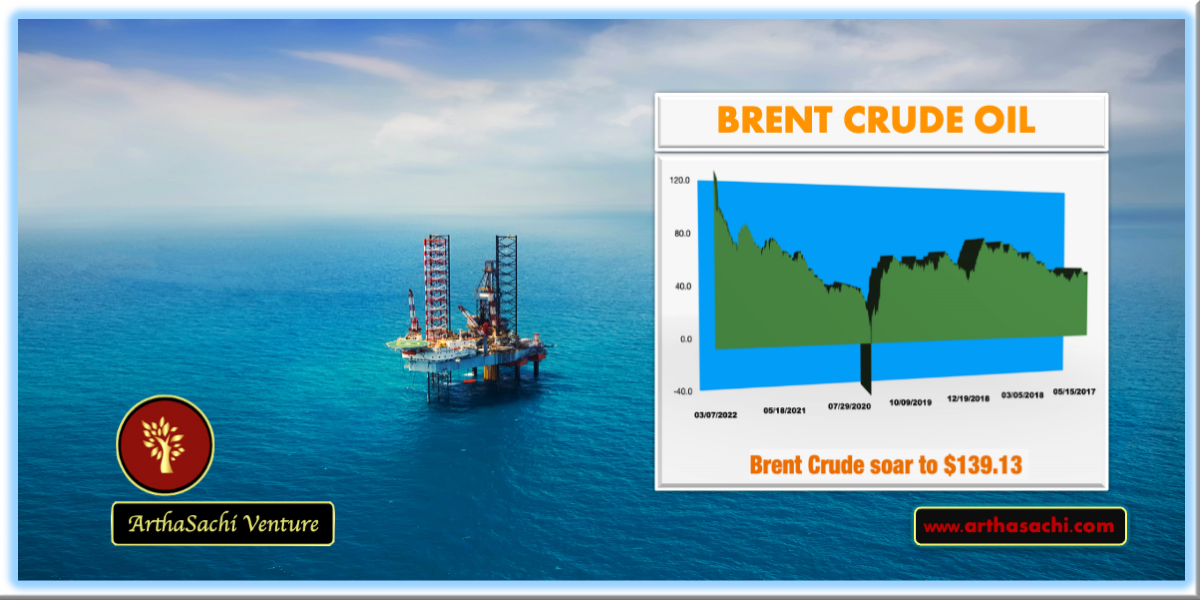

- Oil price soar above 10% on Monday, trading around $130 a barrel before surges to highest seen since 2008 at $139.13 a barrel on the discussion of a possible ban on Russian Oil import.

- Aramco’s decision came after OPEC+, led by Saudi Arabia and Russia, who decided to continue raising output of Oil gradually in its meeting on Wednesday.

- European Equity Market declines were sharper on the moves after Russian forces seized a Ukrainian nuclear plant on Friday. It’s the largest nuclear installation in Europe and covers 25% of Ukrainian energy requirements.

- Federal Reserve has signalled that they will increase rates by at least 0.25% on March 16, and the market is expecting further tightening measures and increase in the interest rates in the coming meetings.

The conflict between Russia and Ukraine within the last two weeks has lighted the Oil price on fire. On Monday, Brent Crude soared to $139.13, a jump of over $20 a barrel, the highest seen since 2008 and WTI at $130.50. Oil price jumped 21 percentage last week itself followed by a rout in European Markets due to conflicts and on the moves after Russian forces seized a Ukrainian nuclear plant on Friday.

On July 2008, Brent touched $147.50 a barrel and WTI contract hit at $147.27.

US gasoline touched to a record high on the Monday trade followed a trigger in Oil price due to heighted tension but closed with a correction of over 4 percentage point. Stock markets headed the opposite way with much deeper correction seen in Europe, US Markets and Asian Markets was not far behind following the downward trajectory. The panic on the trading floors sent haven, Gold, and Silver higher; with Gold closed on Monday at $2001.60 and Silver at $25.81. Many Strategists echoed the sentiment that Oil prices touching $150 a barrel is a real possibility to reach a lifetime high.

Commodity prices has been seen as one of the strongest starts to any year since 2015. Wheat future appreciated 60%, nickel surged 19%, aluminum 15%, zinc 12%. Coal future was trading below $100 per tonne in May-June 2021 and has topped a record high of $430 per tonne amid conflict in Ukraine.

State controlled Saudi Aramco hiked its Arab Light crude for all the regions to more than $115 a barrel having its biggest oil facility in Jeddah, Saudi Arabia. It is now a time when Oil is trading at its highest levels in nearly a decade after escalation in conflicts between Russia and Ukraine. In its meeting on last Wednesday, Aramco’s decision came after OPEC+, led by Saudi Arabia and Russia, decided to continue raising output of Oil gradually.

ECB when it meets this week are happening against the backdrop of a fear of EU entering a stagflation; a sharp falling euro; biggest spike in Oil, Natural Gas and Commodity prices. Euro took a beating last week and fell above 3% to its lowest level since mid 2020.

World Economy looms with the fear of entering into a stagflation where inflation combines with stagnation growth.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints