Sun Pharma Reports Strong Q3FY25 Results with Robust Growth Across Key Markets

Mumbai, January 31, 2025 – Sun Pharmaceutical Industries Limited (Sun Pharma), one of the world’s leading specialty generics companies, announced its financial results for the third quarter of fiscal year 2025 (Q3FY25), showcasing significant growth across multiple business segments.

The company reported a 10.5% year-on-year (YoY) increase in gross sales, reaching Rs. 134,369 million, and a 24.1% YoY rise in adjusted net profit, which stood at Rs. 32,196 million.

Key Highlights of Q3FY25 Performance

Consolidated Financial Performance

- Gross Sales: Rs. 134,369 million, growth 10.5%.

- Adjusted Net Profit for Q3 FY25: Rs. 32,196 million, up 24.1% (excluding the exceptional items)

- Reported New Profit for Q3 FY25: Rs. 29,034 million compared to Rs. 25,238 million in Q3 FY24.

- EBITDA: Rs. 40,090 million, up 15.3% YoY, with an EBITDA margin of 29.3%.

Segment-wise Performance

- India Formulations:

- Sales grew by 13.8% YoY to Rs. 43,004 million, accounting for 32% of total consolidated sales.

- Sun Pharma maintained its No. 1 position in the Indian pharmaceutical market, with its market share increasing from 7.8% to 8.2% as per the AIOCD AWACS MAT Dec-2024 report.

- As per SMSRC (July-Oct 2024) report, we are No.1 ranked by prescriptions in 12 different doctor categories.

- The company launched 12 new products in the Indian market during the quarter.

- US Formulations:

- Sales were US$ 474 million for Q3 FY25, a slight decline of 0.7% YoY, contributing 30% of total consolidated sales.

- For the first nine months, Sales were US$1,457 million recording a growth of 5.7%.

- Despite a slight marginal decline, the US market remains a key focus area, with Sun Pharma holding a strong portfolio of approved ANDAs (Abbreviated New Drug Applications) and NDAs (New Drug Applications).

- Emerging Markets (EM) Formulations:

- Sales grew by 10.1% YoY to US$ 277 million, representing 17% of total consolidated sales.

- For the first nine months, Sales were US$854 million recording a growth of 7.2% YoY.

- The company demonstrated resilience in these markets despite currency challenges across various geographies.

- Rest of World (ROW) Formulations:

- Sales surged by 21% YoY to US$ 259 million, accounting for 16% of total consolidated sales.

- For the first nine months, Sales were US$647 million recording a growth of 5.2% YoY.

- This segment showed strong growth, driven by increased demand in markets outside India, the US, and Emerging Markets.

- Active Pharmaceutical Ingredients (API):

- External API sales grew by 21.8% YoY to Rs. 5,678 million.

- For the first nine months, API Sales were Rs. 15,962 million recording a growth of 6.2% YoY.

- The API business continues to support Sun Pharma’s formulation business and serves customers across multiple geographies.

Research & Development (R&D) Update

- Sun Pharma invested Rs. 8,450 million in R&D during Q3FY25, representing 6.3% of sales.

- The company’s R&D pipeline includes 7 novel entities undergoing clinical trials, with a focus on both specialty and generic businesses.

- In the US, Sun Pharma has 541 approved ANDAs, with 109 ANDAs awaiting US FDA approval, including 28 tentative approvals. Additionally, the company has 51 approved NDAs, with 13 NDAs awaiting approval.

- For the quarter, 6 ANDA were filed and 2 ANDA approvals were received.

Global Specialty Pipeline

Sun Pharma’s Global Specialty portfolio continues to expand, with several key products in various stages of development:

- Ilumya: Currently in Phase 3 trials for psoriatic arthritis, with topline data expected in the second half of CY25.

- Leqselvi: Approved in the US for severe alopecia areata. Company is pending for the outcome of litigation for its launch.

- Nidlegy™: Filed with the European Medicines Agency (EMA) for the treatment of locally advanced, fully resectable melanoma in the neoadjuvant setting (melanoma and non-melanoma skin cancers).

- SCD-044: In Phase 2 trials for atopic dermatitis and psoriasis, with topline data expected in the first half of CY25.

- GL0034: A Phase 1 completed candidate for obesity, with Phase 2 trials set to begin in the first half of CY25.

9-Month FY25 Performance

For the first nine months of FY25, Sun Pharma reported:

- Gross Sales: Rs. 392,257 million, growth of 9.1%

- Adjusted Net Profit: Rs. 90,953 million, up 24.3%

- Net Profit: Rs 87,792 million

- EBITDA: Rs. 115,556 million, up 15.7% YoY, with an EBITDA margin of 29.2%.

Interim Dividend

The Board of Directors declared an interim dividend of Rs. 10.50 per share for FY25, compared to Rs. 8.50 per share in the previous year.

Management Commentary

Dilip Shanghvi, Chairman and Managing Director of Sun Pharma, commented on the results: “Our performance in the quarter showed all-round improvement. Product sales in Global Specialty crossed one-fifth of overall sales. Our market share gain in India has been driven by industry-leading volume growth. Emerging Markets demonstrated strong performance despite currency challenges across geographies. All our businesses remain well-positioned for future growth.”

Conclusion

Sun Pharma’s Q3FY25 results reflect the company’s strong formulations business across its key markets, in India, US, Emerging Markets and ROW. With a robust R&D pipeline and a growing Global Specialty portfolio, Sun Pharma is well-positioned to sustain its growth trajectory in the coming quarters. The company’s focus on innovation, market expansion, and operational efficiency continues to drive its success in the global pharmaceutical industry.

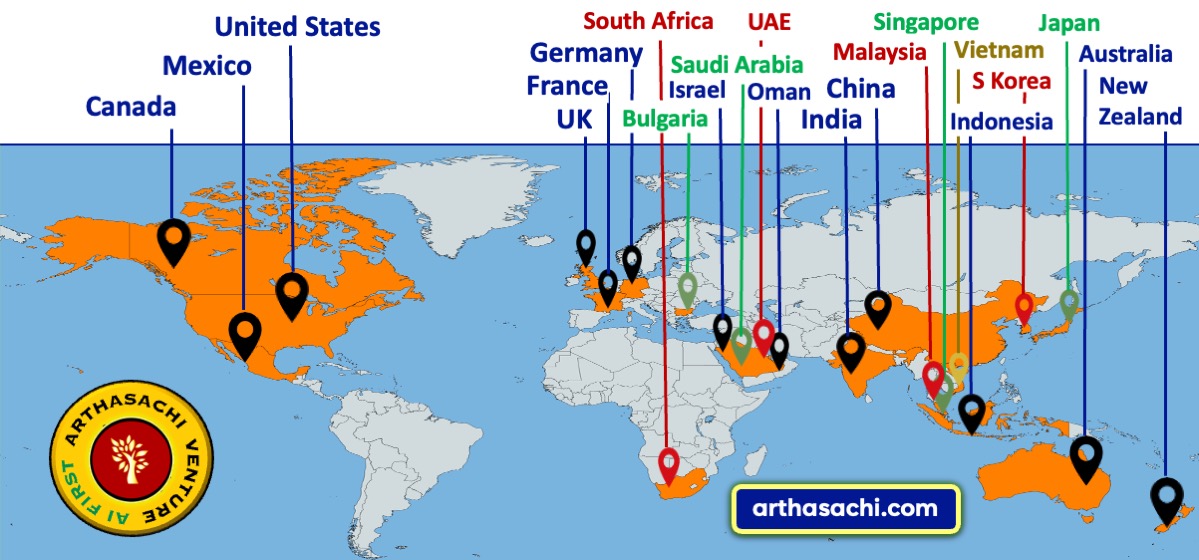

About Sun Pharmaceutical Industries Limited

Sun Pharma is the world’s leading specialty generics company with a presence in Specialty, Generics, and Consumer Healthcare products. It is the largest pharmaceutical company in India and a leading generic company in the US and Global Emerging Markets. Sun Pharma’s high-growth Global Specialty portfolio spans innovative products in dermatology, ophthalmology, and onco-dermatology, accounting for over 18% of company sales. The company operates in over 100 countries and has a multi-cultural workforce drawn from over 50 nations. Its manufacturing facilities are spread across six continents.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints