China and Commodities markets in 2023

Headwinds from the latest global banking crisis has knocked the wind from the sails of the global economy, which has reeled from one crisis to an another in the last 3 years.

Optimism on the global economic outlook for 2023 rose in December`22, when China announced the opening of the country post the Covid restrictions. Global markets were ecstatic with the expected tailwinds from China. IMF upgraded global GDP growth rate forecast for 2023 to 2.9% from 2,7% as it upgraded the Chinese GDP growth rate, for 2023, to 5.2% from ~ 3.5% in 2022. Stock markets too reacted positively with global equity and debt funds pumping in close to $ 11.5bn in December`22, which marked the first month of net inflows into China since February`22, followed by an additional $30bn of inflows in January`23.

As the world`s second largest economy the expected spurt of growth in China was seen as a messiah to the slowdown in Europe and America.

Chinese stakes in commodities markets are high…

Commodities markets, which reflect the global economic conditions, got a boost from the Chinese news with many key commodities prices going up in December`22. As the world's largest consumer and producer of commodities, China's economic growth and demand for major raw materials play a crucial role in the global commodities like iron ore, steel, aluminium, copper, oil, etc. China is expected to account for 35% of the oil demand growth in 2023, 25% in copper, 41% in aluminium and 53% in Zinc! On a long-term basis too, the Chinese government`s “Make in China 2025”, aiming to promote high tech manufacturing, adoption of electric vehicles, infrastructure, etc. is expected to create a huge demand for many metals like steel, copper, zinc, aluminium, etc. Similarly, the buildup integrated oil to chemicals complexes like Hengli Petrochemicals is expected to create a big demand for oil, gas, etc.

China economic indicators post Lunar New Year holidays …

Economic indicators emanating from China, for February`23 and March`23, post the Lunar New Year Holidays, have been very encouraging.

- Manufacturing PMI for February`22 was at 51.6 and crossed 50 for the first time since July`22.

- New loans issued by banks in January`23 was at RMB 4,900 bn ($720bn) as compared to last 6 months monthly average of ~ RMB 1,790bn ($255bn)

- Steel production rates represented by blast furnace operating rates was at a healthy 84%

- Two of the largest traded commodities globally – iron ore and crude oil got a huge boost from the expected Chinese demand uptick. Iron ore prices moved by ~ 20% since December`22 while OPEC increased China`s oil demand growth estimate by ~ 8% in March`23

- Bulk freight rates, which is an indicator of commodities movement and industrial demand, has seen a major increase in China bound routes. Bauxite and coal shipments bulk freight rates, from South America and Guinea, have moved up by 15-20% since early February`23.

So, does this mean that China will power the commodities growth upwards in 2023 and is this positive trend sustainable for 2023? I have my reservations on it, given the soft signals from various factors.

1) China`s budget for 2023 has been muted for housing and infrastructure sectors...

China`s 14th National Congress has spelt out the clear objectives for the Chinese economy for 2023. In short, the government has spelt out a conservative growth plan for 2023 as compared to expectations of an explosive growth. Some of the key pointers from the Congress which indicates a reserved growth rate:

- GDP growth rate in 2023 expected at 5% as compared to earlier expectations of 5.5% +.

- Fiscal deficit at 3% vs 2.8% in 2022 which indicates that the government is not going for a major fiscal stimulus. India`s fiscal deficit for 2023-24, for that matter, is 6.4%

- Importantly, the housing sector, which is the key for commodities markets, will be subjected to a control for “unregulated expansion.”

- Infrastructure build, another sector which is vital for commodities, too will see a controlled spending only.

- Major focus will be on consumer spending, create more jobs and take steps to reverse the trend of declining population. China has been trying to convert its economy to a consumer spending led economy rather than an export and capital formation led economy for past many years.

2) Exports markets will be muted due to global slowdown…

Chinese growth over the last 20 years has been powered by its exports business. Due to the global slowdown, contribution of the next exports to Chinese GDP crashed to – 42% in Q4`22 from 24% in Q3`22 due to the global slowdown. With global markets in a slowdown exports markets growth will be slow. Chinese manufacturing industries, especially in metals like aluminium, zinc, and copper, are dependent to about 20-25% on the global markets, in basic as well as value added exports. For example, in the aluminium business, China is not only a major exporter of aluminium metal but also a major exporter of fabricated aluminium products to various parts of the world.

3) Private sector investment to the Gross Capital Formation (GCF) can be low...

Thanks to the political developments in China, the communist party has taken an iron grip on the country as well as over the private sector. Technology sector has been heavily under the government`s scanner over the last few years. The stories of treatment to private entrepreneurs like Jack Ma as well as the disappearance of the Chinese banker Bao Fan doesn’t exude much confidence in the Chinese private sector.

Over the last 3 years, the government owned enterprises and joint ventures have contributed to about 80% of the industrial value add to the economy. With no major stimulus due to fiscal deficit controls and the private sector issues, industrial value add will have a muted growth only. Also, Gross Capital Formation (GCF) contribution to the GDP has been lagging the consumption expenditure over the last 6 quarters. As the Chinese government does not plan to increase its fiscal deficit in a big way, GCF formation can be muted and hence a drag on commodities demand.

4) Chinese economy structure has undergone a shift towards tertiary economy...

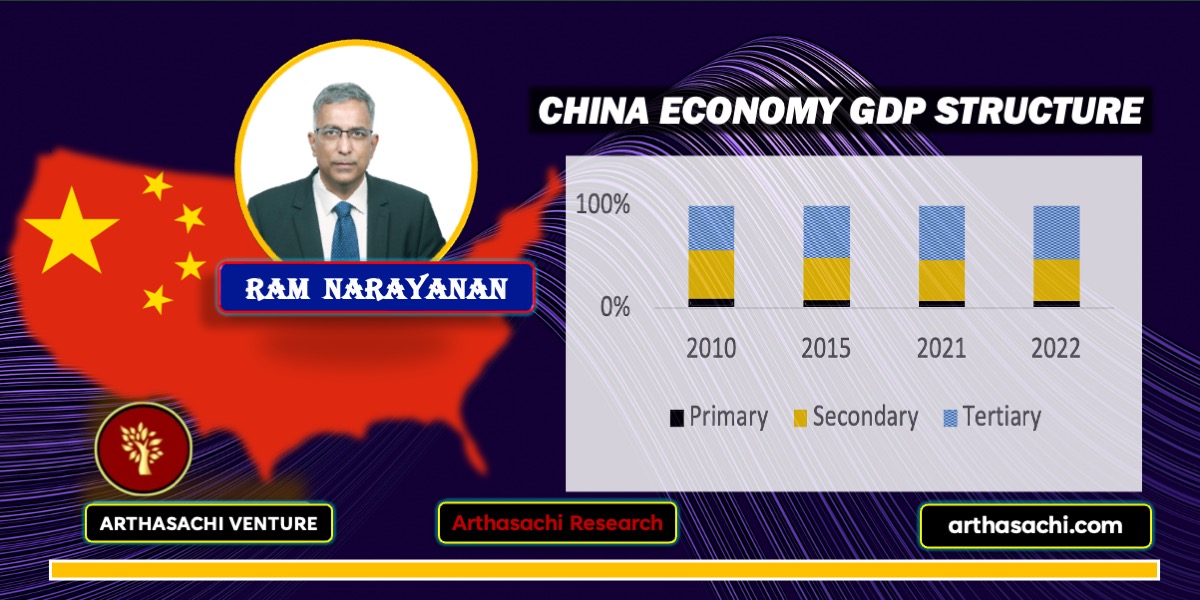

Chinese economic structure has moved more towards end consumer-based economies like banking, insurance, services, etc. as compared to the primary industries like extraction, agriculture, and secondary industries like manufacturing. In 2010, the tertiary economy accounted for 43% of the economy which has moved up to 53% in 2022. Secondary and primary economies which accounted for 56% of the economy have presently moved down to ~ 43%. Thus, China's shift towards a more service-oriented and innovation-driven economy could potentially result in reduced demand for basic commodities like steel while potentially increasing demand for others like lithium, etc in long term.

5) Geopolitical pressures on China due to Russia stance will play on sanctions.

Due to China`s pro Russia stand in the war and tensions with the western world especially due to the Taiwan issue, Chinese trade will be the target of many trade sanctions. Apart from being a major trade partner with Russia, China has also been a trade hub for Russia. For example, China has been feeding alumina to Russian aluminium smelters while importing alumina from Australia and other countries to feed its own smelters. Chinese chips industry too has been a target for western sanctions.

To summarize, despite tailwinds from China seen so far this year, there are still many structural issues that will affect the commodities business demand in China in 2023. One key factor is that the government`s priorities as announced in the budget, isn’t on infrastructure and housing, while secondly the global economic conditions and China`s geopolitical stands will be another hurdle.

Hence commodity products, which are very dependent upon China, may have a limited upside. Hence, I find it difficult to envisage China playing a major bull factor for the global commodities markets. However, in the interest of the global economy and commodities markets, I would like to be proved wrong!!

About the author

Ram Narayanan is Group Director – Market Development (Metals Business) at Vedanta Limited, Mumbai India. His Career spanning over 24 years reflecting pioneering experience in multi businesses - chemicals, metals, and optic fiber cable businesses. His multi-functional experience covers – strategy formulation and execution, P&L management, sales & marketing, procurement and supply chain functions. Ram’s multi – cultural working experience includes working in China, Taiwan, Malaysia and India and experienced in handling businesses in Asia, Middle East, Africa and Europe.

Disclaimer: This website will contain articles, dialogue or discussion contributed by several individuals. The views are exclusively their own and do not necessarily represent the views of the website or its management. The linked sites are not under our control, and we are not responsible for the contents of any linked site, or any link contained in a linked site, or any changes or updates to such sites. arthasachi.com is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement by us on the site. For more information on this please visit our website.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints