China’s Crude Oil Markets & its impact on Global Oil Prices in 2023

China is the world's second-largest consumer of crude oil, after the United States, and its crude oil production has been declining in recent years. This means that China has become increasingly dependent on imported crude oil to meet its growing demand for energy.

China is the world’s largest consumer and producer of commodities, its economic growth and demand for major raw materials play a crucial role in the global commodities like iron ore, steel, oil etc. China is expected to account for 35% of the oil demand growth in 2023. Hengli Petrochemicals and similar integrated oil to chemicals complexes is expected to create a big demand in China for oil, gas etc.

China's crude oil production peaked in 2015 at 4.3 million barrels per day (bpd) and has since declined to around 3.7 million bpd in 2020. On the other hand, China's crude oil demand has been steadily increasing, reaching around 14.5 million bpd in 2020, according to the International Energy Agency (IEA).

The increase in China's crude oil demand and the decline in its domestic production have contributed to the country's growing dependence on crude oil imports. In 2020, China imported an average of 11.3 million bpd of crude oil, making it the world's largest crude oil importer.

The impact of China's crude oil production, demand, and imports on the global crude oil price is significant. China's growing demand for crude oil has been a major driver of global crude oil demand and prices. As China's economy continues to grow, its demand for crude oil is likely to increase further, putting upward pressure on global crude oil prices.

At the same time, China's crude oil imports have also been affected by global crude oil prices. When global crude oil prices rise, China's crude oil import bill increases, which can have an impact on its economy and energy security.

In the year 2023, Russia replaced Saudi Arabia to be China’s top oil supplier. China imported 15.68 million tonnes in January-February or 1.94 million barrels per day (bpd), a growth of 23.8 per cent from 1.57 million during the same period in the year 2022 as per the data released by the General Administration of Customs, China. Saudi Arabia was the top supplier of Crude oil in the year 2022, China imported 87.49 million tonnes of crude oil in 2022.

In addition, any disruptions to China's crude oil production or imports, such as political tensions or supply chain disruptions, can have a significant impact on global crude oil prices. This was seen in early 2020 when the COVID-19 pandemic led to a decline in China's crude oil demand and a drop in global crude oil prices.

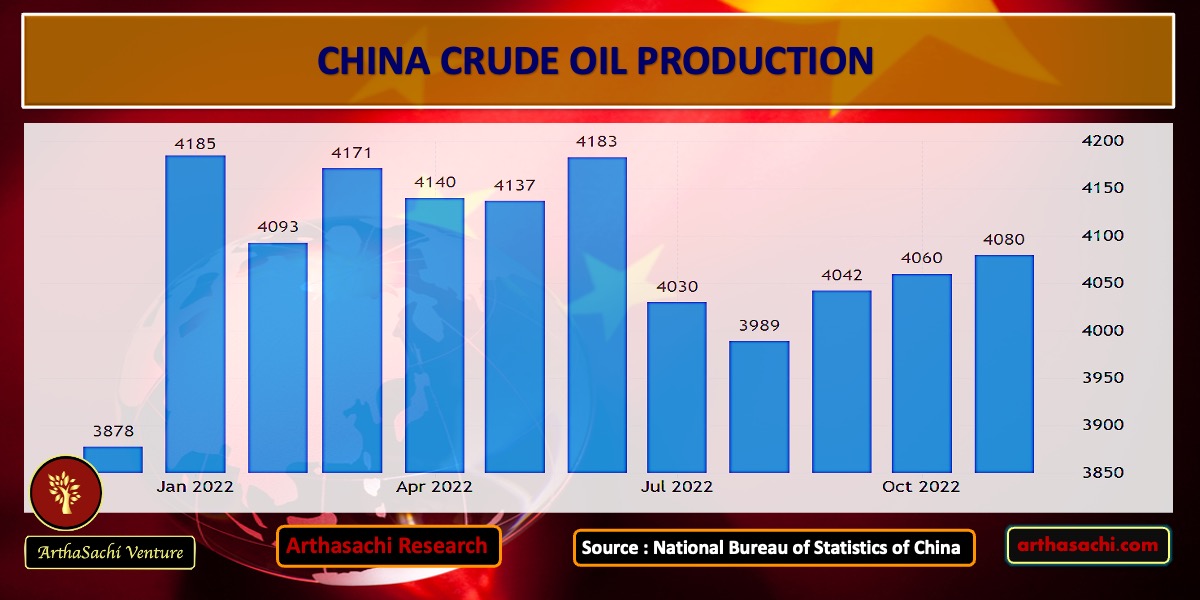

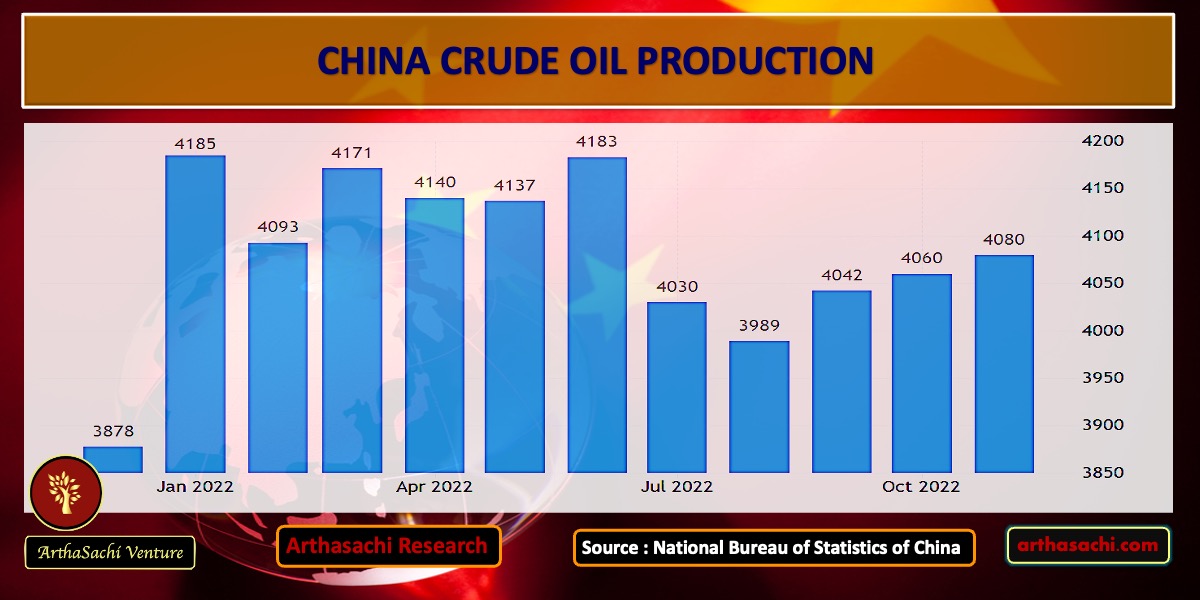

Crude Oil Production in China

Crude Oil Production in China increased to 4080 BBL/D/1K in November from 4060 BBL/D/1K in October of 2022.

China Energy Production

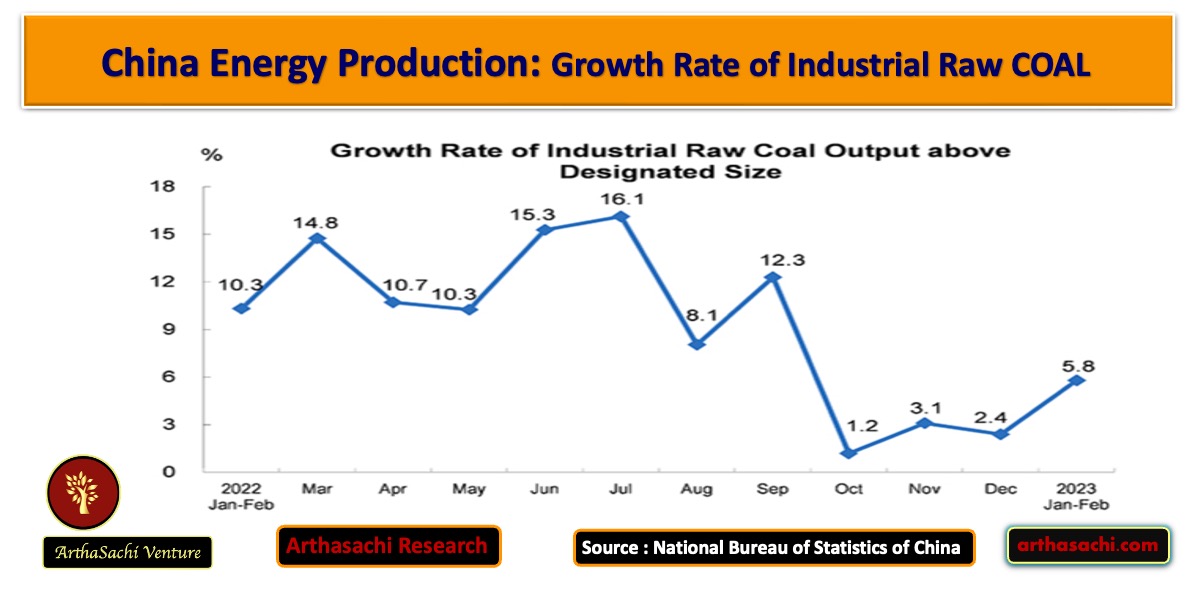

During the months of January and February, there was a growth in the production of primary energy by industries that are considered to be of a certain size. Raw coal and natural gas production saw an increase in their growth rate compared to the previous month of December, while crude oil and electric power production experienced a slowdown.

In particular, there was a significant increase in the growth rate of raw coal production, and the import of coal also rebounded considerably. Over the two months, the production of raw coal reached 730 million tons, with a year-on-year increase of 5.8 percent, which was 3.4 percentage points faster than the growth rate of the previous month. The average daily output was 12.44 million tons. Additionally, coal imports saw a year-on-year increase of 70.8 percent, with 60.64 million tons being imported, which was only a slight decrease of 0.1 percent from the previous month of December.

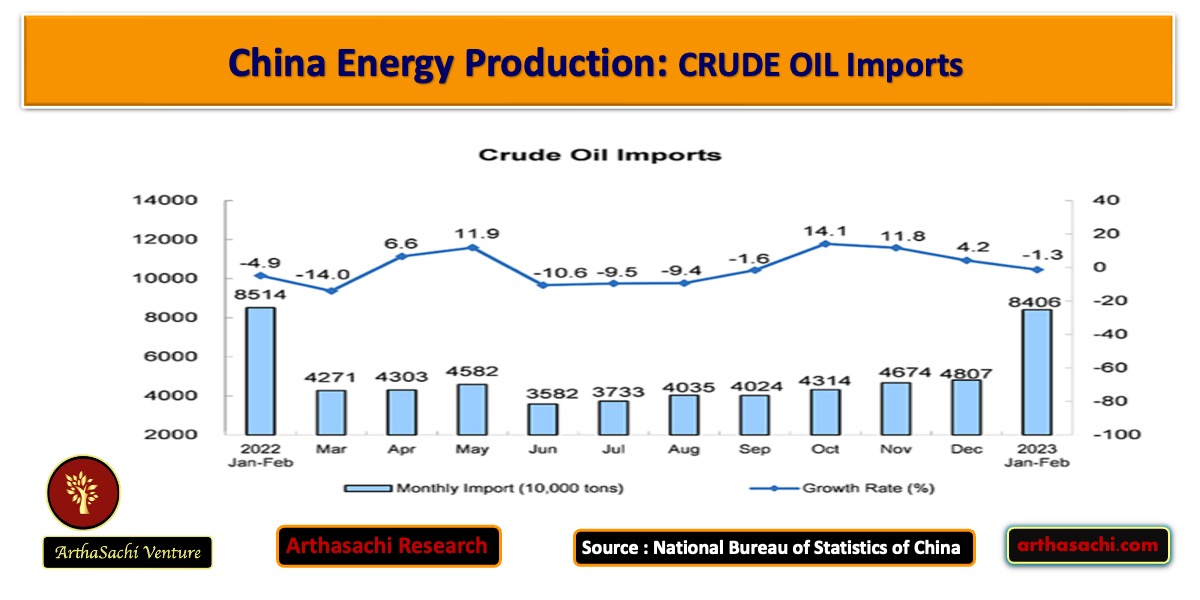

CRUDE OIL

The rate of growth in crude oil production showed a slight slowdown, and the trend of import changed from an increase to a decrease. Over the months of January and February, the production of crude oil reached 34.17 million tons, which was a year-on-year increase of 1.8 percent, but 0.7 percentage points lower than in December of the previous year. The average daily output during this period was 579,000 tons. On the other hand, the import of crude oil decreased year-on-year by 1.3 percent to 84.06 million tons. This was a shift from the previous month of December, where there was an increase of 4.2 percent in crude oil imports.

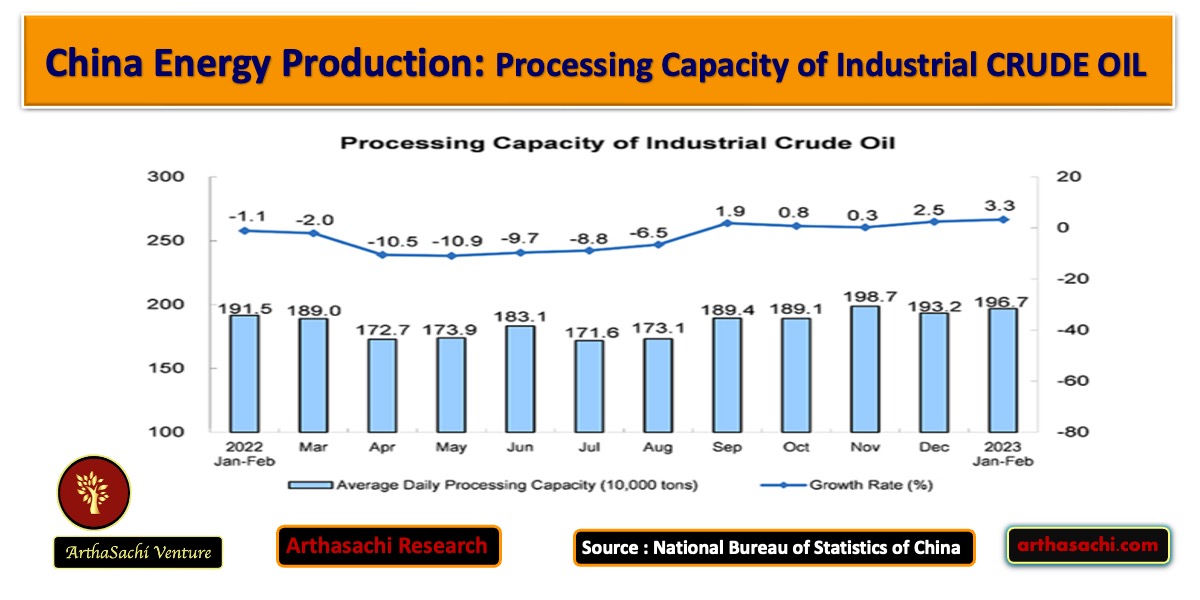

There was an acceleration in the growth of crude oil processing volume. Over the months of January and February, a total of 116.07 million tons of crude oil were processed, which represented a year-on-year increase of 3.3 percent. This growth rate was 0.8 percentage points faster than that recorded in December of the previous year. The average daily processing volume during this period was 1.967 million tons.

China's pro-Russian stance during conflicts and tensions with the West regarding its Taiwan policies puts it at a significant risk of facing trade embargoes and sanctions in the future. Moreover, the Chinese chip industry has become a focal point of tension in the recent past in its relationship with the US and other Western countries. Russia replaced Saudi Arabia to be China’s top oil supplier in the first two months of 2023. China buys Russian oil at multi-month steep discounts, brushes off price cap imposed by Western countries.

China’s role in crude markets is key and whether domestic demand there bounces back sufficiently will determine a great deal of how global flows move in the future. Overall, China's crude oil production, demand, and imports are closely watched by the global oil market, and any changes in these factors can have a significant impact on global crude oil prices. In view of all the above developments Crude Oil trading above $ 100 looks very remote in the year 2023.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints