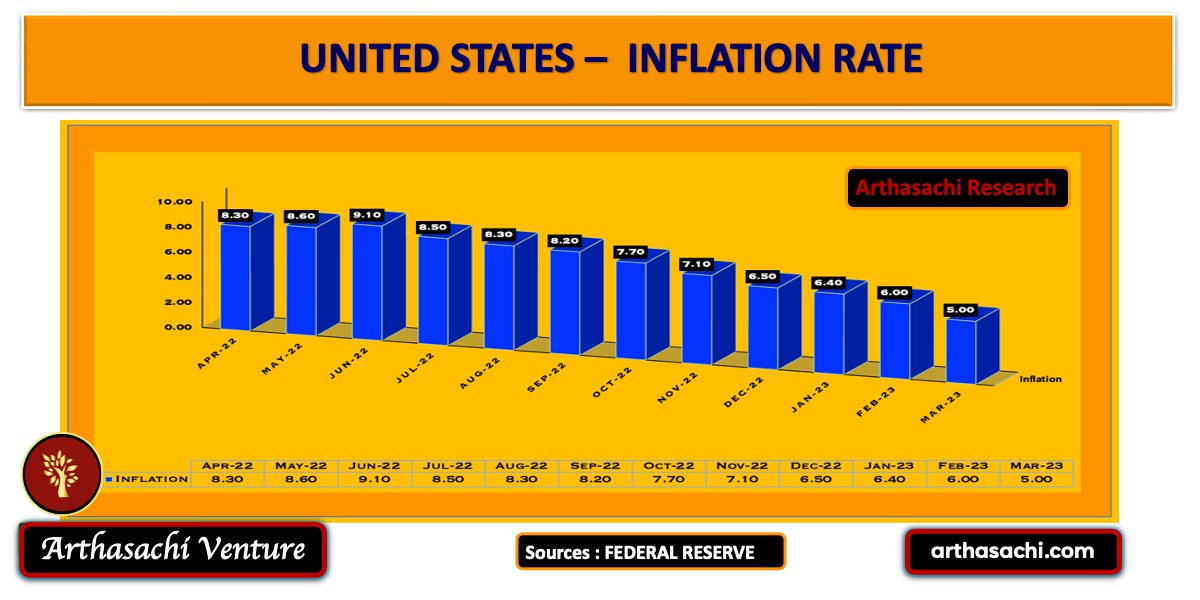

US Inflation rate fall to 5% well above Fed target rate of 2%

US Monthly consumer price index shows prices increased at a lowest rate since 2021, even though core inflation remains fairly steady.

In March of 2023, the annual inflation rate in the United States decelerated for the ninth consecutive time to 5%, which is the lowest level since May 2021, down from 6% in February, and below the market projections of 5.2%. The cost of food grew at a slower pace (8.5% versus 9.5% in February), and energy expenses decreased (-6.4% compared to +5.2%), particularly for gasoline (-17.4%) and fuel oil (-14.2%). In contrast, the prices for used cars and trucks fell once more (-11.6% versus -13.6%). However, inflation for shelter, which makes up more than 30% of the entire Consumer Price Index (CPI) basket, continued to climb (8.2% versus 8.1%).

The CPI rose by a marginal 0.1% compared to the previous month, also falling below the expected 0.2%, with higher shelter prices (0.6%) offsetting a 3.5% drop in energy expenses. Food prices remained unchanged. The Core CPI, which excludes food and energy, rose as anticipated by 5.6% over the year and 0.4% over the month.

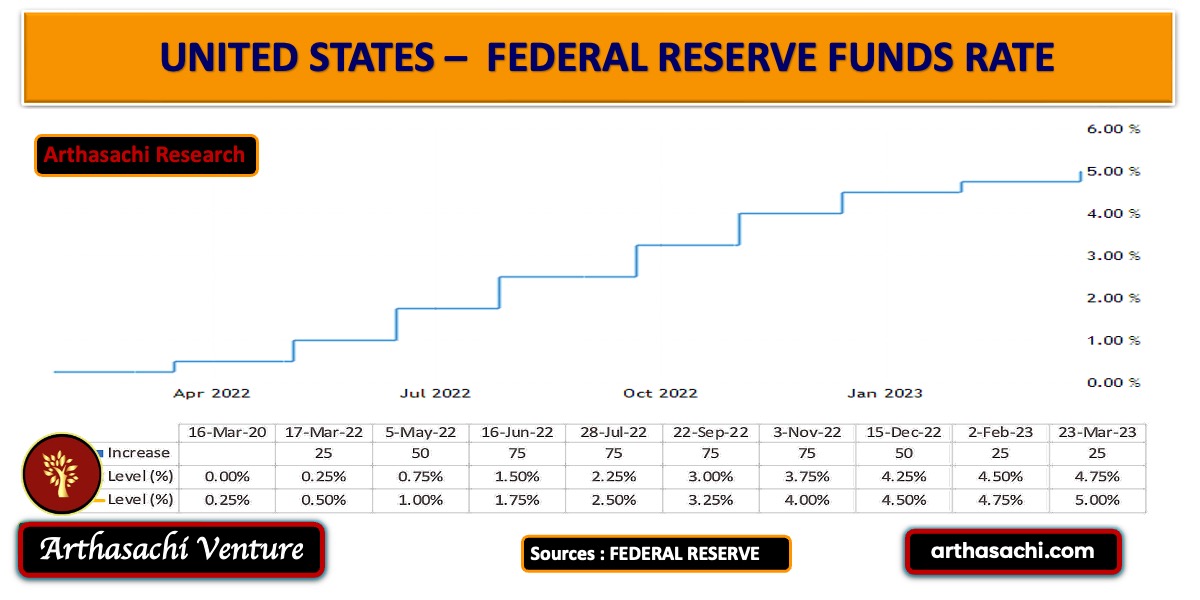

Economist and Analyst views are fairly divided even though the overall inflation rate is on a downward journey. The hardship on the common public and businesses is quite evident as they are fighting on multiple front; inflation, tightening credit conditions for households and businesses, uncertain economic condition, recession fear and risk of banking crisis after the collapse of Silicon Valley Bank. It’s important to note the Fed has increase the interest rate nine consecutive times over the last year. The pace at which it is raised from 0.25% on March 17, 2022, to 5.00% on March 23, 2023, impacted the US Economy in a big way.

On Banking risk Powell statement is critical which he delivered on March 22, 2023 (FOMC Meetings), “In the past two weeks, serious difficulties at a small number of banks have emerged. History has shown that isolated banking problems, if left unaddressed, can undermine confidence in healthy banks and threaten the ability of the banking system as a whole to play its vital role in supporting the savings and credit needs of households and businesses. That is why, in response to these events, the Federal Reserve, working with the Treasury Department and the FDIC, took decisive actions to protect the U.S. economy and to strengthen public confidence in our banking system. These actions demonstrate that all depositors’ savings and the banking system are safe.”

Powell also added, “The events of the last two weeks are likely to result in some tightening credit conditions for households and businesses and thereby weigh on demand, on the labor market, and on inflation. Such a tightening in financial conditions would work in the same direction as rate tightening. In principle, as a matter of fact, you can think of it as being the equivalent of a rate hike or perhaps more than that.” He concluded, “At the end of the day, we will do enough to bring inflation down to 2%. No one should doubt that.”

The labor market shows a slight colling off, the unemployment rate dropped 0.1% and stands at 3.5%. It added 236,000 jobs in the month of March.

Economist and Analyst are keeping a close eye on the next Fed board meeting, where it will announce any upcoming interest rate increase, on 2 May and 3 May.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints