RBI Monetary Policy: Governor Shaktikanta Das hiked repo rates by 50 Bps, focus moved to support Growth

RBI Governor, Shaktikanta Das says that the MPC decided to hike the policy repo rate by 50 basis point under the liquidity adjustment facility (LAF) to 5.4 percent.

KEY TAKEAWAYS

- Consequently, Bank Rate and the marginal standing facility (MSF) rate changed to 5.65 percent.

- The standing deposit facility (SDF) rate, will be changed to 5.15 percent.

- The consumer price index (CPI) inflation medium term target kept at 4 percent within a band of +/- 2 percent, while supporting growth.

- The MPC decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

- The real GDP growth projection for 2022-23 is retained at 7.2 percent.

- The CPI Inflation is projected at 6.7 percent in 2022-23. And for Q1: 2023-24 is projected at 5.0 percent.

- Overall economic activity appears to have picked up.

Inflation

Headline CPI inflation eased to 7.0 per cent YoY during May-June 2022 from 7.8 per cent in April, although it persists above tolerance band.

Food inflation has registered some moderation, especially with the softening of edible oil prices, and deepening deflation in pulses and eggs.

Fuel inflation inched back to double digits in June primarily due to the rise in LPG and kerosene prices. While core inflation (i.e., CPI excluding food and fuel) moderated in May-June due to the full direct impact of the cut in excise duties on petrol and diesel pump prices, effected on May 22, 2022, it remains at elevated levels.

![]()

Inflation outlook, are based on the below assumption:

- A normal monsoon in 2022

- Average crude oil price (Indian basket) of US$ 105 per barrel

- Rising kharif sowing augurs well for the domestic food price outlook.

- Cost pressures to soften across sectors in H2

- Cost pressures are, however expected to get increasing transmitted to output prices across manufacturing and services sector.

- Food and metal prices have come off their peaks

The inflation projection is retained at 6.7 per cent in 2022-23, with Q2 at 7.1 per cent; Q3 at 6.4 per cent; and Q4 at 5.8 per cent, and risks evenly balanced. CPI inflation for Q1:2023-24 is projected at 5.0 per cent.

GDP

Investment activity is expected to get support from government’s capex push, improvement in government’s capex push, improving bank credit and rising capacity utilisation. The outlook for growth, rural consumption is expected to benefit from the brightening agricultural prospects. The demand for contact-intensive services and the improvement in business and consumer sentiment should bolster discretionary spending and urban consumption.

![]()

As per RBI estimates, the real GDP growth for 2022-23 is retained at 7.2 percent, with Q1 at 16.2 percent; Q2 at 6.2 percent; Q3 at 4.1 percent; and Q4 at 4.0 percent. Real GDP growth for Q1 2023-24 is projected at 6.7 per cent.

Merchandise Trade

Merchandise exports grew in April-July 2022 while merchandise imports surged to record high on the back of elevated global commodity prices. Consequently, the merchandise trade deficit expanded to US$ 100.0 billion in April-July 2022. Provisional data indicate that demand for services exports, especially IT services, remained buoyant in Q1 despite global uncertainty. Exports of travel and transport services also improved in Q1:2022-23 on a year-on-year basis.

Import of capital goods increased robustly in February. All categories of imports, however has risen even faster, leading to merchandise trade deficit at an annual level of US $ 192 billion in 2021-22 or 6.1 percent of GDP.

Agriculture

On Agriculture side touched new record; food grains production touch a new record in 2021-22, with both Kharif and Rabi output crossing the final estimates for 2020-21 as well as the targets set for 2021-22.

Manufacturing & Services

Continuing the momentum of robust performance of the sector during Q4 2021-22, the manufacturing PMI continued to be in the expansionary zone clocking 53.9 in June, slightly lower than 54.6 in May. The slight dip may be attributed to the moderation in new export orders with the weakening in the growth of world output.

Data on eight core industries' production in May also showed resilience. All industries registered positive growth on a year-on-year and sequential basis. The sequential momentum of steel and fertilizer production remained strong. Coal and electricity production also remained almost 14 per cent above pre-pandemic levels of 2019. Capacity utilisation in the manufacturing sector is Q4: 2021-22 was 76.3 per cent relative to its long-term average of 73.7 per cent.

Broadbased recovery in service activity continued in the first quarter of 2022-23, with PMI services rising further to 59.2 in June from 58.9 in May. The expansion can be attributed to improvements in demand following the retreat of pandemic restrictions, capacity expansion, and a favourable economic environment. Freight data also signalled resilience, with railway freight continuing to expand in double-digit by 11.3 per cent on a year-on-year basis in June 2022.

Liquidity & Foreign Exchange Reserves

RBI maintained overall system liquidity in large surplus, with an average daily absorption under the LAF at ₹3.8 lakh crore during June-July. Money supply (M3) and bank credit from commercial banks rose (y-o-y) by 7.9 per cent and 14.0 per cent, respectively, as on July 15, 2022.

India’s foreign exchange reserves were placed at US$ 573.9 billion as on July 29, 2022.

Banking

Indian banking system has strengthened its risk absorption capacity over the years. Asset quality of Scheduled Commercial Banks (SCBs) is improving steadily over the years across all major sectors. Gross non-performing assets (GNPA) ratio has decreased from 7.4 per cent in March 2021 to a six- year low of 5.9 per cent in March 2022.

Bank credit growth has accelerated to 14.0 per cent (y-o-y) as on July 15, 2022 from 5.4 per cent a year ago. Incoming data of corporates for Q1 indicate that sales and demand conditions and profitability of manufacturing sector remained buoyant.

Forex Market

During the current financial year (up to August 4), the US dollar index (DXY) has appreciated by 8.0 per cent against a basket of major currencies. In this milieu, the Indian Rupee has moved in a relatively orderly fashion depreciating by 4.7 per cent against the US dollar during the same period – faring much better than several reserve currencies as well as many of its EME and Asian peers. The depreciation of the Indian rupee is more on account of the appreciation of US dollar rather than weakness in macroeconomic fundamentals of the Indian economy.

Investment

India’s net foreign direct investment (FDI) at US$ 13.6 billion in Q1:2022-23 was robust as compared to US$ 11.6 billion in Q1:2021-22. Foreign portfolio investment, after remaining in exit mode during Q1:2022-23, turned positive in July 2022.

Risk

Elevated risk emanating from protracted geopolitical tensions, the upsurge in global financial market volatility and tightening global financial conditions continue to weigh heavily on the outlook.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

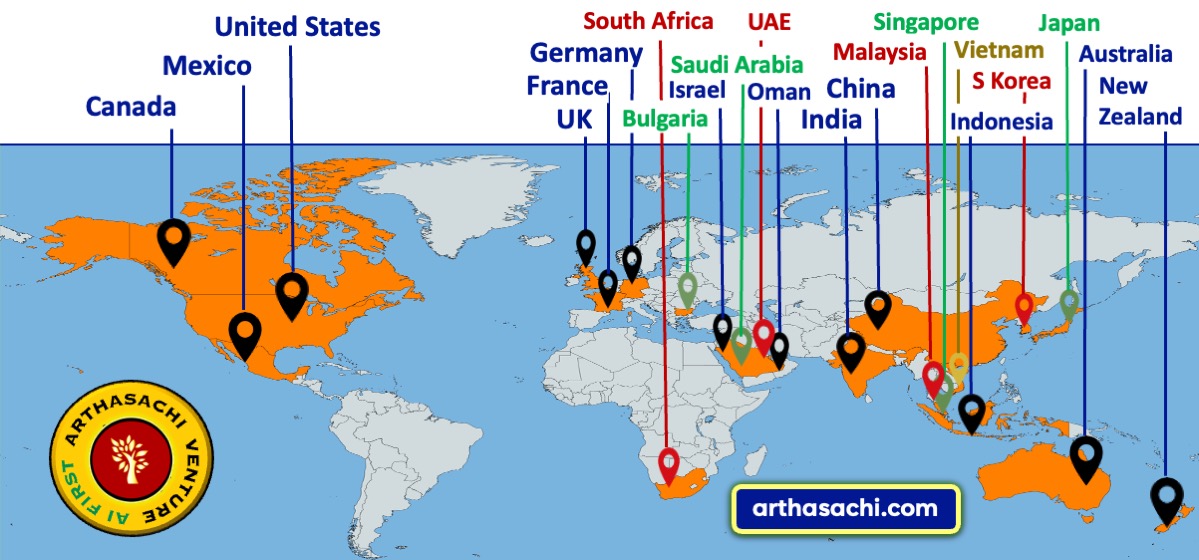

Alliances and Partners

Arthasachi Venture Footprints