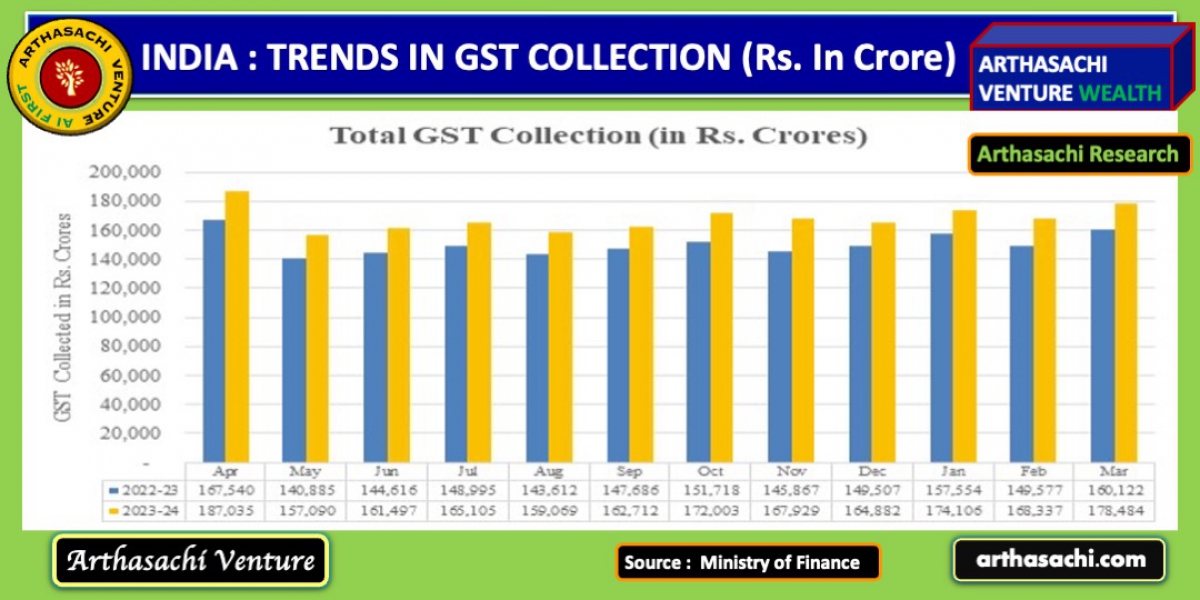

India's GST Revenue Hits Record High in March 2024, Continuing Strong Growth Trend

In a testament to India's economic resilience and growth trajectory, the Gross Goods and Services Tax (GST) revenue for March 2024 has surged to an impressive ₹1.78 lakh crore, marking the second-highest collection ever recorded. This achievement is underscored by an impressive 11.5% year-on-year growth, reflecting the robustness of the country's tax framework amidst dynamic economic landscapes.

Driving Factors Behind the Surge

The remarkable surge in GST collection for March 2024 primarily stems from a significant increase in domestic transactions, witnessing a commendable 17.6% rise. This indicates a buoyant domestic market, characterized by heightened economic activities and consumer spending, which bodes well for India's economic outlook.

Consistent Performance in Fiscal Year 2023-24

The fiscal year 2023-24 has proven to be exceptionally promising, with total gross GST collection surpassing ₹20 lakh crore, marking an impressive 11.7% increase compared to the previous year. The average monthly collection for this fiscal year stands at ₹1.68 lakh crore, exceeding the previous year's average, signifying a sustained upward trajectory in revenue generation.

Positive Performance Across Components

A breakdown of the March 2024 collections reveals a positive trend across various components:

- Central Goods and Services Tax (CGST): ₹34,532 crore

- State Goods and Services Tax (SGST): ₹43,746 crore

- Integrated Goods and Services Tax (IGST): ₹87,947 crore

- Cess: ₹12,259 crore

Similar encouraging trends are observed throughout the fiscal year, reaffirming the robustness of India's tax structure and its ability to generate revenue across diverse sectors.

Inter-Governmental Settlements

The inter-governmental settlements further underscore the harmonious collaboration between the central and state governments in revenue sharing. In March 2024 alone, the Central Government disbursed ₹43,264 crore to CGST and ₹37,704 crore to SGST from the IGST collected, translating to substantial revenue streams for both entities. For the fiscal year 2023-24, the settlements amounted to ₹4,87,039 crore and ₹4,12,028 crore for CGST and SGST respectively, reflecting a concerted effort towards equitable revenue distribution.

Conclusion

The record-high GST revenue for March 2024, coupled with consistent growth trends throughout the fiscal year, underscores India's resilience and economic vibrancy. As the nation continues its journey towards sustainable development and inclusive growth, the robust performance of GST collections serves as a beacon of optimism, reflecting the collective efforts of stakeholders in driving economic prosperity and fiscal stability.

By embracing innovation, fostering collaboration, and prioritizing fiscal prudence, India is poised to leverage its economic potential and emerge as a global leader in the post-pandemic era.

Through transparent governance and strategic reforms, India is laying the foundation for a prosperous future, where economic growth is synonymous with social progress and inclusive development.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints