BIMA SUGAM A NEW AVATAR OF INSURANCE

After changing the Global Landscape of Payment System. Indian Government is putting its hands on Insurance Section through its new avatar "BIMA SUBAM."

IRDAI has proposed to setup an online MarketPlace for selling all kinds of Insurance Products. IRDAI proposed to Dematerialized the Insurance Policy through this move, it could mean cheaper premiums and greater convenience to the Customers. Insurance Companies in Indian Market will reap huge benefit, it would cut down the large commission which is being paid to its agents or third party to sell their products which run from 10% to over 30% depends on type of Insurance Policy.

India's Insurance Sector is on an exponential growth path, growing at a rate of 32-34% each year. India is the fifth largest life Insurance Market in the world's emerging markets. Growth in the Industry can be attributed to multiple reasons; the fastest growing middle class, growing incomes, and growing awareness in the Industry.

Promoting Foreign Direct Investment in the sector is another reason for the growth which is allowed up to 26% under the automatic method. The Insurance Industry in India has 57 Insurance companies - 24 are in the life Insurance business while 34 are non-life insurers. LIC remains the prominent player among the life Insurance holding its market share of 53%, other prominent players are ICICI Prudential Life Insurance and HDFC Standard life. India's overall density stood at US$ 78 in FY21. India's Insurance penetration was at 4.2% in FY21.

As per Government estimates Premiums from India;s life Insurance Industry is expected to reach Rs 24 lakh crore (US$ 317.98 billion) by FY31. The gross premium of life Insurers increase by 12.93% in 2021-22 to Rs 314,261 crore (US$ 40 billion).

India is the second-largest Insurance Technology Market in Asia-Pacific accounting for 35% of the US$ 3.66 billion InsurTech focused venture Investments made in India. Life Insurance Industry in India is expected to increase by 14-15% annually for the next three to five years.

Let's analyse how "Bima Subam" would impact the overall Insurance Industry.

- Insurance aggregator in the Indian Market like Policy Bazar will hit badly due to direct hit on their Margin, also in long run as UPI captured the major payment transactions in India. Similarly Customers will move away the aggregator to "Bima Subham."

- Biggest Beneficiary in the whole chain is of course the end Customers as in case of UPI Payments; it enhanced the Customer Experience, volume and reduce the cost by almost one tenth times in long run. Results on similar line can be expected from this move.

- Insurance Companies in Indian Market can offer the Policies at a very competitive price which might be made available to the customers at a much higher discounted price available currently.

- In long run it will enhance the penetration of Insurance Policies due to much competitive options for the Customer. A larger population would be covered under Insurance which is lagging behind the western counties.

- Indian Government promoted Centralised Depositories Registered companies, NSDL and CDSL which hold multiple forms of securities like stocks, bonds, ETFs and more as electronic copies will benefit immensely from this move. As most of the new Insurance Policies would be issue in the Dematerialised form with either NSDL or CDSL.

Bima Subham has the potential to change the complete landscape of Global Insurance Market due to its unique business model and framework which has the potential of change the way Insurance business run globally over multiple decades now.

Our suggestion to Investors, enhance your exposure in top Insurance companies in India. Also move your funds from aggregator to top Insurance Companies in Indian Market.

For more specific details download our FREE App "Arthasachi Venture Wealth" and subscribe to our NEWSLETTER.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

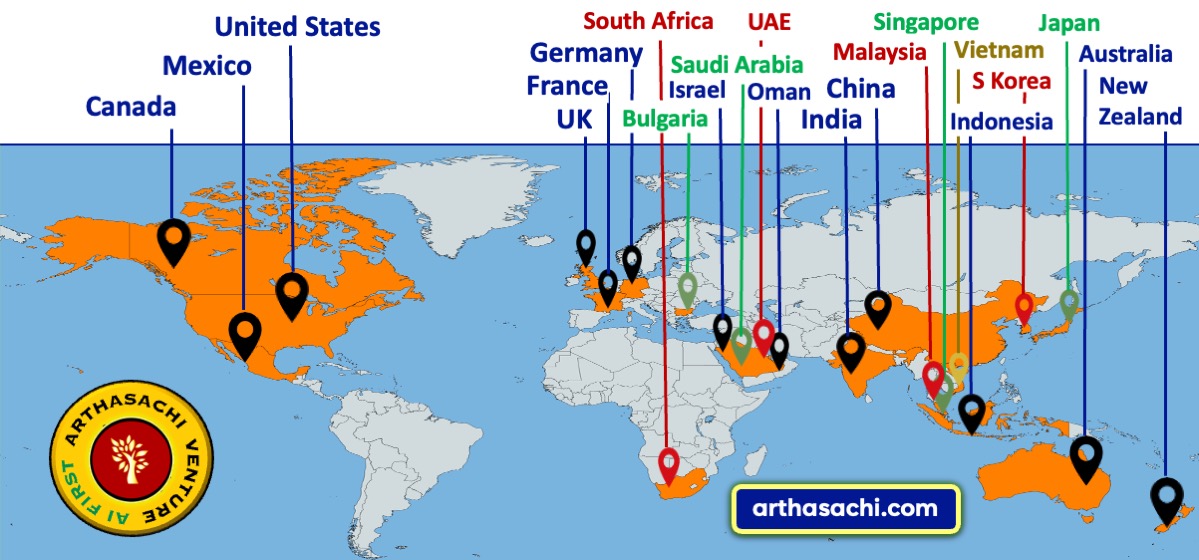

Arthasachi Venture Footprints