European Central Bank signals July rate hike, end net asset purchases

The European Central Bank confirmed plans to end its stimulus scheme under APP as of 1st July 2022, on the back of high inflation which rose to 8.1% in May.

KEY TAKEAWAYS

- The economy will grow more slowly in the future. As per latest forecast annual real GDP growth at 2.8% in 2022. 2.1% in 2023.

- Inflation is much higher than the expected and will stay high for some time, Inflation rose to 8.1% in May.

- The Governing Council intend to raise Interest rate by 0.25% in July. Also expect to increase them again in September. Post that it will depend on how Inflation develops.

- ECB to ensure that Inflation stabilises at 2% target over the medium term.

- In this meeting the Governing Council maintain the status quo and held back the rate hike in this meeting.

President of the ECB, Christine Lagarde in its Monetary Policy statement, retained the benchmark rate contrary to Fed Reserve hike recently, and has signal July rate hike. The Euro area economy forecast for annual real GDP growth at 2.8% in 2022. The outlook has been revised downward as per March projections.

Inflation

Inflation increased to a record 8.1 percent in May, from 7.5 percent in March. Higher Energy price remain the biggest contributor which stand 39.2 percentage above their level one year ago. As per ECB estimates Energy prices will stay high in the near term. Food prices have also increased sharply, rose to 7.5% in May due to elevated transportation, production cost and price of fertilisers. Supply bottlenecks and the normalization of demand due to reopening of the economy is also putting pressure on prices.

![]()

ECB internal estimates have revised their baseline inflation projection up significantly. As per the new projections foresee annual inflation at 6.8% in 2022.

GDP

The conflict between Russia and Ukraine continues to weigh on the economy in Europe and beyond. It is disrupting trade, is contributing to high energy and commodity prices and added by disruption in supply chain. These factors will continue to weigh on confidence and dampen growth.

![]()

As per Euro system staff projections, which foresee annual real GDP growth at 2.8% in 2022. 2.1% in 2023 and 2.1% in 2024. The outlook has been revised significantly downward as per March projections.

The Governing council during this period will maintain optionality, data-dependence, gradualism and flexibility in the conduct of Monetary Policy.

ASSET PURCHANSE PROGRAMME (AAP)

The Governing Council decided to end net asset purchases under asset purchase programme (APP) as of 1st July 2022. The Council intends to continue reinvesting, in full the principal payments from maturing securities purchased under APP for an extended period of time past the date when it starts raising the key ECB interest rate and, in any case for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.

Interest Rates

The Governing Council decided to leave the interest rate on the main refinancing operations and interest rates on the marginal lending facility and the deposit facility unchanged at 0.00%, 0.25% and -0.50% respectively.

The Governing Council decided to move away from negative Interest Rates, and intend to raise the key ECB interest rate by 25 basis pints at July Monetary policy meeting.

The Governing Council is expected to raise the key ECB interest rate again in September. The calibration of this rate increase will depend on the updated medium-term inflation outlook. If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at our September meeting.

Beyond September, based on the Council current assessment, they anticipate that a gradual but sustained path of further increases in interest rates will be appropriate. In line with the Council commitment to 2% medium-term target of Inflation, the pace at which they adjust the monetary policy will depend on the incoming data and how they assess inflation to develop in the medium term.

Labour Market

The labour market continues to improve, with unemployment remaining at its historical low of 6.8% in April on back of robust demand for labour. Wage growth has started to pick up.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

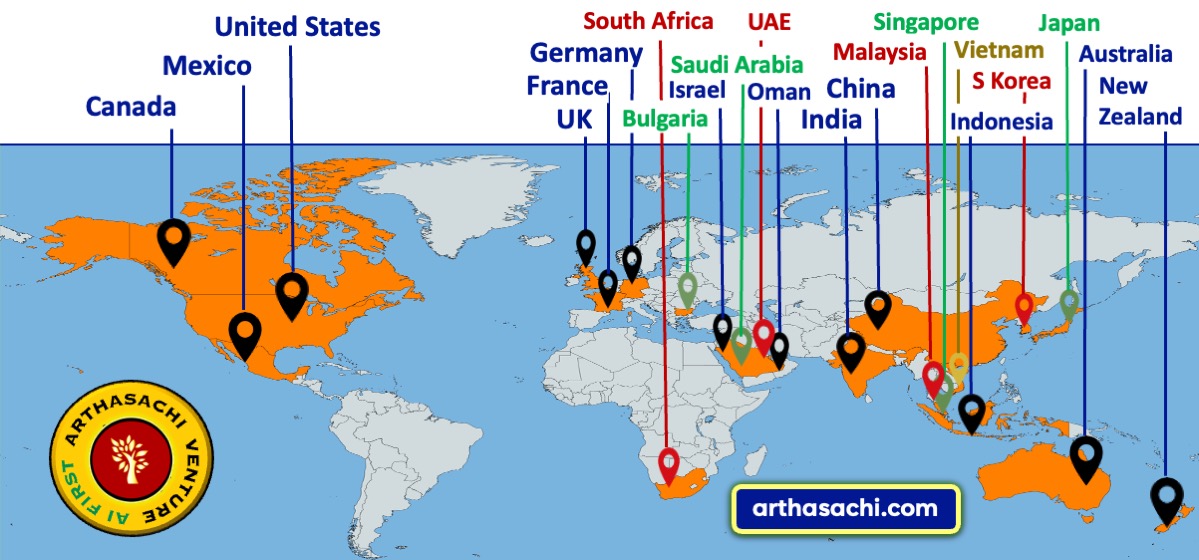

Arthasachi Venture Footprints