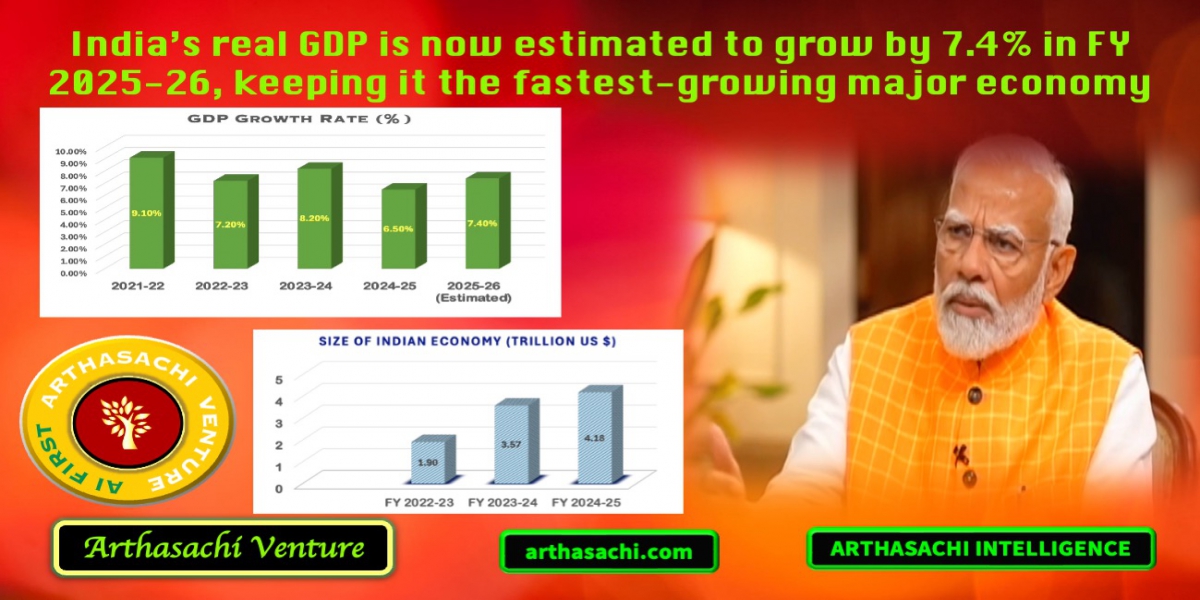

The First Advance Estimates (FAE) of national income for FY 2025‑26 have been issued by India’s National Statistical Office (NSO) under the Ministry of Statistics and Programme Implementation (MoSPI). The NSO has stated that “real GDP has been estimated to grow by 7.4 per cent in FY 2025‑26 against the growth rate of 6.5 per cent during FY 2024‑25,” with nominal GDP projected to rise by about 8.0 per cent, forming the macro basis for the upcoming Union Budget.

Prime Minister Narendra Modi has described this as evidence that “India’s Reform Express continues to gain momentum,” underscoring that sustained reforms, infrastructure push, and demand‑led policies are driving the upgraded outlook.

Factors supporting the 7.4% growth

Multiple structural and cyclical drivers are aligning to support this higher growth trajectory and keep India at the top of the global growth league among large economies. Key factors highlighted in official and multilateral assessments include:

Investment‑led expansion: Real gross fixed capital formation is projected to grow about 7.8% in FY 2025‑26, reflecting continued infrastructure spending (roads, rail, logistics, digital), capacity creation in manufacturing, and crowd‑in of private investment.

Domestic demand strength: Real private final consumption expenditure is estimated to rise around 7%, supported by rising incomes, urban consumption, formal job creation, and expanding services, offsetting weaker external demand.

Broad‑based sectoral momentum:

Services GVA is projected to grow about 7.5–9.9%, led by financial, real estate and professional services, public administration, defence and other services, and trade‑transport‑communication segments.

Manufacturing and construction GVA are both expected to grow near 7%, helped by PLI schemes, housing and infrastructure, and resilient corporate profitability.

Agriculture and allied activities are projected to grow modestly (~3.1%), still providing a stabilising base despite weather and climate risks.

Supportive macro policy backdrop: The Reserve Bank of India (RBI) has raised its FY 2025‑26 real GDP forecast to about 7.3%, citing easing inflation, healthy industrial output, improving rural demand, and strong services exports, while still maintaining financial stability and policy space. External agencies such as the Asian Development Bank and India Ratings (Fitch Group) have aligned forecasts near 7.2–7.4%, reinforcing confidence that India will remain the fastest‑growing large economy globally.

Why the US 50% tariff has not dented India’s growth

The US decision to impose a 50% tariff on select Indian exports has undoubtedly created headwinds for specific sectors, particularly labour‑intensive manufacturing segments that are more US‑oriented. However, three features of India’s growth model have limited the macro damage:

Domestic‑demand‑driven growth: India’s recent growth has been driven overwhelmingly by internal consumption and investment rather than net exports, so the drag from targeted US tariffs remains modest relative to the size of the economy.

Diversified export markets and services strength: While some merchandise lines face higher US duties, India’s services exports (IT, business services, global capability centres) remain robust and diversified across markets, helping offset pressure on goods shipments.

Policy and corporate adjustment: Exporters have begun re‑routing trade to alternative markets, adjusting product mixes, and leveraging trade agreements with partners such as the UAE, UK, Japan, EU and key Asian economies, which reduces the long‑term impact of unilateral tariff shocks.

Why India is uniquely placed – and on course to be the 3rd‑largest economy

Several structural advantages make India uniquely positioned to sustain higher growth and move from its current position as the 4th‑largest economy toward becoming the 3rd‑largest in coming years:

Demographic and market scale: With a young, high skilled population and with a rising participation in the Global technological growth Industry both within India and outside India. India is building a large, productivity‑enhancing workforce and a vast domestic market. This underpins steady consumption growth and supports long investment cycles in housing, infrastructure and services.

Reform and formalisation agenda: Tax reforms (GST), digital public infrastructure, insolvency and bankruptcy processes, FDI liberalisation, and production‑linked incentives have gradually improved formalisation, compliance, and ease of doing business, creating a more efficient growth platform.

Macroeconomic resilience and credibility: A more rules‑based monetary framework, one of best run Central Bank (RBI), better‑anchored inflation expectations, comfortable FX reserves, highest inward remittances attraction from NRI and prudent external debt management have reduced India’s vulnerability to global shocks, allowing higher growth with macro stability than many peers. International comparisons by institutions such as the UN and multilateral development banks consistently show India at or near the top of global growth tables for large economies, strengthening the case for it to climb the GDP rankings.

India has overtaken Japan to become the 4th Largest Economy and on course to be the 3rd Largest economy Globally: India has overtaken Japan to become the world’s fourth largest economy. According to NITI Aayog CEO B.V.R. Subrahmanyam, “India is now poised to displaced Germany from the third rank in the next 2.5 to 3 years. India is just behind the United States, China and Germany’s economies which are larger than India.”

The shift is being underpinned by India’s sustained growth momentum at a time when several advanced economies face structural slowdowns. The IMF, in its World Economic Outlook report, reiterates India’s position as the world’s fastest growing major economy Globally and the only largest nation expected to clock over 6 per cent growth in the next two years. According to the report, the high rate of growth will see India’s GDP increasing to $5.5 trillion in 2028 overtaking Germany to become the third largest economy. In contrast, Germany’s outlook remains subdued. The IMF forecasts zero growth in 2025, followed by a modest 0.9 per cent expansion in 2026, as Europe’s largest economy is expected to bear a disproportionate impact from ongoing global trade war.

Taken together, these trends signal more than a change in rankings. They point to a structural rebalancing of global economic influence, with India emerging as a central pillar of growth in an increasingly multipolar world economy.

Growth, poverty reduction and the rise of India’s middle and wealthy classes

Sustained real average GDP growth rate of 7.68% in the last five years (include estimated growth for the FY 2025-26) is translating into measurable poverty reduction and a rapid expansion of the middle‑income and high‑net‑worth population. World Bank and other multilateral assessments have noted a sharp fall in extreme poverty in India. As per Indian Government published figure in Jan 2024, India uplifted 248.2 million people over the last nine years from multidimensional poverty, driven by growth, targeted transfers, and improvements in basic services.

As incomes rise due to growth momentum and urbanisation accelerates, a large population are transitioning into a consumption‑oriented middle class, HNI, and Super HNI boosting demand for luxury goods, housing, automobiles, education, healthcare, travel, and discretionary services that further reinforce growth.

Parallelly, India has seen fast growth in the number of high‑net‑worth individuals (HNIs) and ultra‑HNIs, with private wealth reports consistently ranking India among the fastest‑growing pools of financial wealth. This combination of poverty reduction at the base and scale‑up at the top is creating a market size, across income tiers, that is increasingly difficult for global companies and investors to ignore.

How UPI and RuPay have reshaped India’s digital payments landscape

Unified Payments Interface (UPI) has fundamentally transformed India’s digital economy by making instant, low‑cost, interoperable payments available to virtually every smartphone user. Global Digital economy and their payment system are look at India to reform and transform their broken system. UPI continued to scale the Global and India’s digital landscape in 2025, handled 228.3 billion transactions in 2025 setting new benchmark. It processed transactions worth 299.76 Lakh Cr rupees in value last year, making India one of the world’s largest real-time payments markets.

Displacement of traditional card rails: The combination of UPI and the domestic RuPay network has significantly eroded the share of legacy card schemes such as Visa and Mastercard in everyday retail payments, especially for small‑ticket and person‑to‑merchant transactions. RuPay cards have crossed the 1‑billion mark, command a lion share in the Indian Markets due to advance technology, nominal transaction charges vis-à-vis Visa and Master Card and benefitting from government programmes (like Jan Dhan), zero‑MDR policies and native UPI integration that make them the default for many customers and merchants.

Inclusion and formalisation: By enabling micro‑transactions, QR‑based payments and direct bank‑to‑bank transfers even in tier‑2/3 towns and rural areas, UPI has pulled millions into the formal financial system, enriched credit data trails, and lowered transaction costs for small businesses and self‑employed workers. This digital rails revolution is now tightly interwoven with GST, direct benefit transfers and credit platforms, amplifying productivity and tax buoyancy.

What lies ahead – India marching toward a “vikasit” nation

Looking ahead, the 7.4% growth estimate serves both as validation of past reforms and as a benchmark that policymakers want to maintain or exceed on the path to a “vikasit” (developed) India. The NSO’s Advance Estimates and the RBI’s upgrade suggest that if investment, productivity and fiscal prudence are sustained, India can remain a rare large economy combining high growth with relative macro stability.

The policy agenda now centres on deepening manufacturing and exports, accelerating skill and labour‑market reforms, strengthening climate‑resilient infrastructure, and ensuring that digital and financial inclusion translate into higher productivity and better jobs across the income spectrum. If these priorities are executed alongside continued institutional strengthening and predictable policy, India’s transition from a fast‑growing emerging market to a truly developed, innovation‑driven economy will increasingly look like a matter of timing rather than possibility—anchored by the kind of growth momentum reflected in the 7.4% estimate for FY 2025‑26

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints