India & Singapore embark towards rationalisation of International Fund Transfer charges

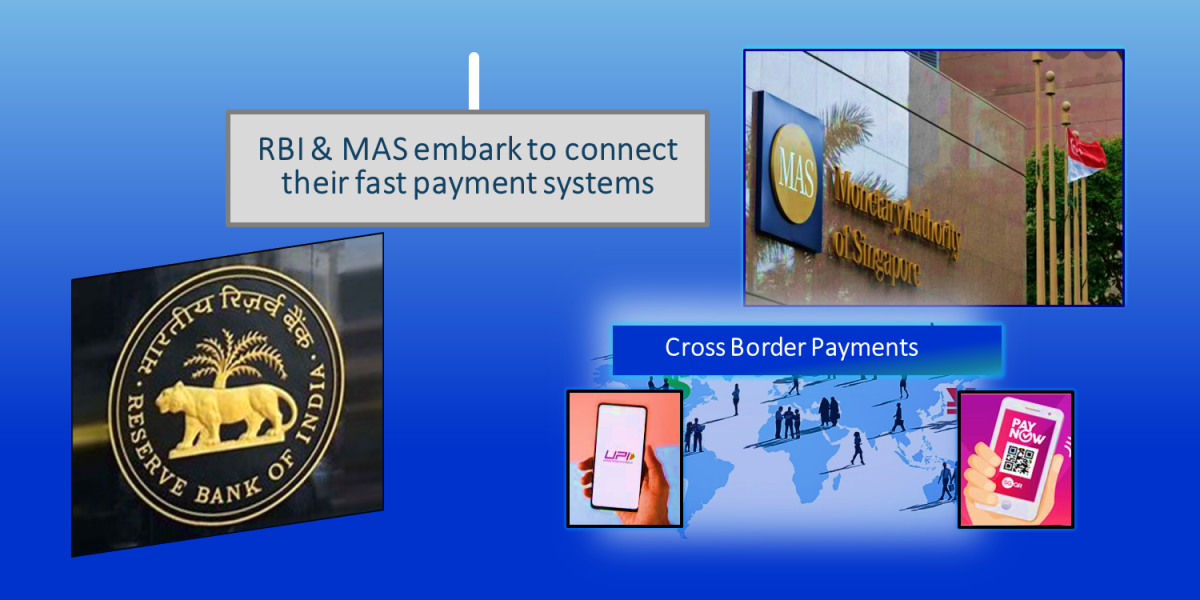

The Monetary Authority of Singapore (MAS) and the Reserve Bank of India embark to connect their respective fast payment systems, India’s UPI and Singapore’s PayNow. The linkage is targeted for operationalisation by July 2022.

It will be an important milestone in cross-border Payment Connectivity. India is the largest recipient of inbound remittances across the globe accounting for 15% of global share, in the year 2020, India received $83 billion. The PayNow-UPI linkage will enable users to make instant, low cost fund transfers directly from one bank account to another between Singapore and India. When implemented, fund transfers can be made from India to Singapore using mobile phone numbers, and from Singapore to India using UPI virtual payment addresses (VPA). The experience of making a PayNow transfer to a UPI VPA will be similar to that of a domestic transfer to a PayNow VPA in Singapore now.

The PayNow-UPI Linkage is a significant milestone in the development of infrastructure for cross-border payments between India and Singapore, and will poster priorities of driving faster, cheaper and more transparent cross-border payments. The linkage builds upon the efforts of NPCI International Private Limited (NIPL) and Network for Electronic Transfers (NETS) to foster cross-border interoperability of payments using cards and QR codes, between India and Singapore and will further anchor trade, travel and remittance flow between the tow countries.

Sopnendu Mohanty, Chief FinTech Officer of MAS, said, “By reducing the cost and inefficiencies of remittance between Singapore and India, the PayNow-UPI linkage will directly benefit individuals and businesses in Singapore and India that greatly rely on this mode of payment. Given that PayNow and UPI are integral components of their respective national digital infrastructures, the link between the two systems also paves the way for establishing more comprehensive digital connectivity and interoperability between the two countries.”

UPI is India’a mobile based, ‘fast payment’ system that facilitates customers to make round the clock payments instantly using Virtual Payment Address (VPA) created by the customer. This eliminates the risk of sharing bank account details by the remitter. UPI supports both Person to Person (P2P) and Person to Merchant (P2M) payments as also it enables a user to send or receive money.

PayNow is the fast payment system of Singapore which enables peer-to-peer funds transfer service, available to retail customer through participating banks and Non-Bank Financial Institutions (NFIs) in Singapore. It enables users to send and receive instant funds from one bank or e-wallet account to another in Singapore by using just their mobile number, Singapore NRIC/FIN, or VPA.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints