Indian Mutual Fund Industry’s grew at rapid pace in financial year 2020-21

Asset size of Indian Mutual Fund Industry grew by 40 percent in financial year 2020-21

Mutual fund (MF) asset size has grown at a rapid pace in financial year 2020-21. According to data from AMFI, MF Industry asset size grew to Rs 31.42 trillion in 2020-21, which is 40 percent higher than the previous financial year. India’s stock market has seen one of biggest market rallies in recent time which brought the Investor back to Mutual Fund Industry. Distribution Income is showing a sign of tepid growth a sign of maturity in the Market and industry is heading for a major Digital transformation to cut down on cost.

Mutual Fund Industry Asset Growth

Industry is heading toward Direct plans

Digital has taken centre stage in Mutual Fund Industry, online modes of Investment retained as a popular option among tech savvy Investor. India’s middle class, HNI and HNWI population are growing at rapid pace, as expected next decade of Global growth momentum are expected to be driven by Asia continent and India’s and China will lead this growth. India’s large cities are contributing to growth in higher asset allocation towards Mutual Fund Industry.

Mutual Fund Industry are heading towards mammoth growth

India is yet to realise its full potential of Mutual Fund Industry, as assets under management are just 12 percent of India’s GDP, whereas the global average is 63 percent. In the coming decade India’s Mutual Fund Industry are heading towards mammoth growth to cater to one of the fastest growing middle, HNI and HNWI. India’s GDP growth expect to grow in double digit this year as per IMF forecast, and becoming one of the fastest growing economy in the coming years. Mutual Fund Industry adoption to Digital transformation will augment its contribution to India’s GDP above 30 percent in the coming years.

How top-ten distributors did in 2020-21

In recent years, MF distributors have been seeing their earning decline. In 2018-19, their earning has declined by seven percent to Rs 7,948 crore. In 2019-20, their earnings has declined by another 22 percent to Rs 6,148 crore.

Decline Distribution Income trend are visible among top players in the market barring NJ IndiaInvest and State Bank of India.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

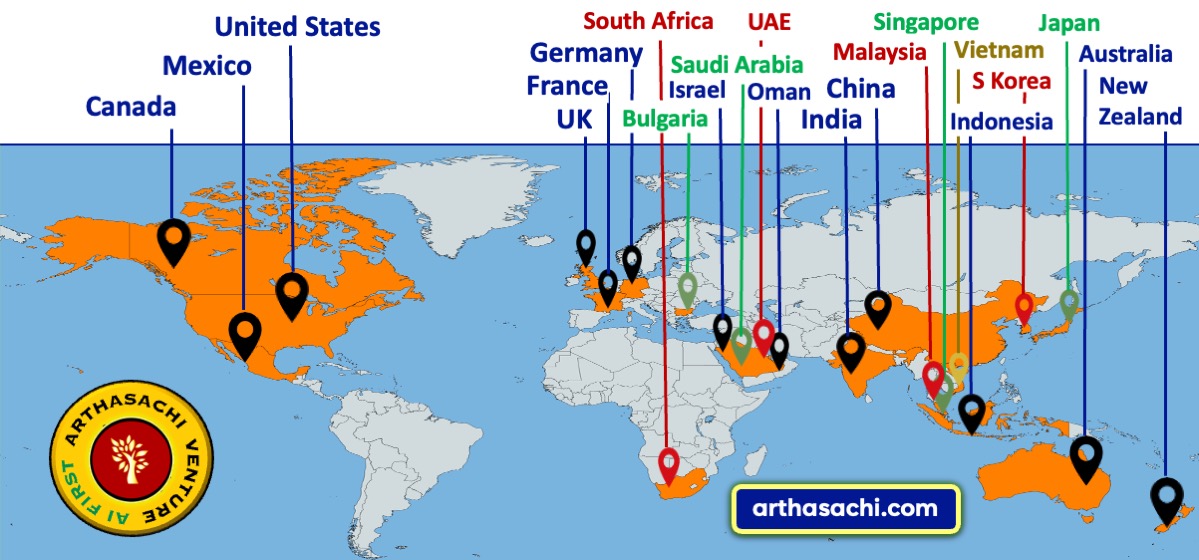

Alliances and Partners

Arthasachi Venture Footprints