MCX To Build New Technology Trading Platform On TCS BaNCS Product

Tata Consultancy Services (TCS) has been selected by the Multi Commodity Exchange (MCX), India’s largest commodity exchange to build a new technology platform for trading as well as post-trading functions.

The project, dubbed Udaan, TCS will help MCX build a new technology, to support its future growth and further strengthen its leadership position in the commodity derivative market in India. It will design and deploy a cutting-edge, ultra-low latency high availability, resilience and performance solution that integrates multiple systems to transform MCX’s operations end-to-end.

TCS will utilise the trading platform it uses for the Deutsche Borse Group, as well as its own BaNCS platform to cover post-trade activities such as clearing, risk management, delivery, settlement and will help MCX in meeting its current and future business needs. The project is expected to go live sometime in the second half of next year, the company said.

TCS Financial Solutions, Co-Head R Vivekanand said, “Increasing trading volumes, longer trading hours, new asset classes, and higher retail participation are driving forward thinking exchanges and market infrastructure institutions to accelerate their transformation. A large growing economy like India has immense future potential in Commodity markets. We are delighted to partner with MCX in building a future proof platform to enable this growth. Our strong presence across Indian markets, unique market know-how, intellectual property, and ability to put together a world class solution will help us play a pivotal role in helping MCX drive its transformation.”

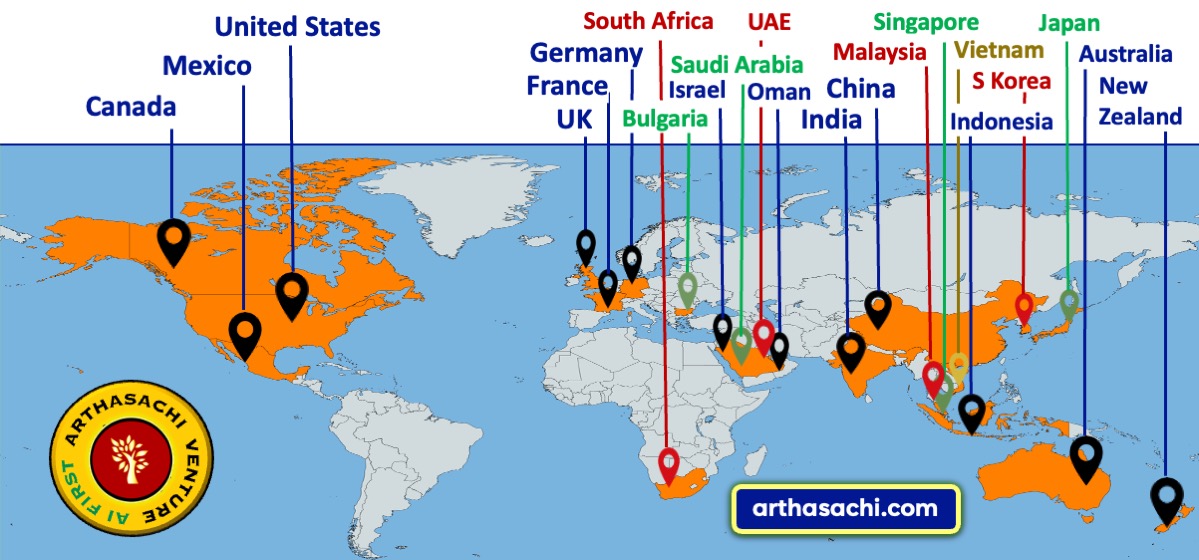

TCS BaNCS product for Market Infrastructure is a world leading solution for CSDs, central counterparty clearing houses, exchanges and central banks, adopted by market infrastructure institutions in over 25 countries for their mission critical business needs. With its unique ability to support multiple markets, currencies, and asset classes on the same platform, and its support for a wide range of messaging standards that enable real-time interfaces with market participants and external ecosystems, it has been a key catalyst in driving transformation in many markets worldwide.

The Multi Commodity Exchange of India Limited (MCX), India’s first listed exchange, commodity derivatives exchange that facilitates online trading of commodity derivatives transactions, thereby providing a platform for price discovery and risk management. MCX offers trading in commodity derivative contracts across varied segments including bullion, industrial metals, energy and agricultural commodities, as also on indices constituted from these contracts. It is India’s first Exchange to offer commodity options contracts, bullion index futures and base metals index futures contracts.

Top News

Other News

MARKETS

WEALTH

ECONOMICS

START UP

TECHNOLOGY

BUSINESS

Alliances and Partners

Arthasachi Venture Footprints