Markets News

EARNINGS

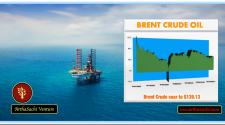

Commodities News

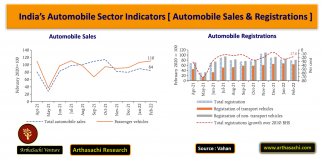

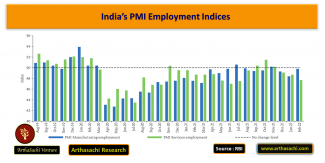

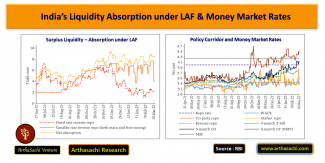

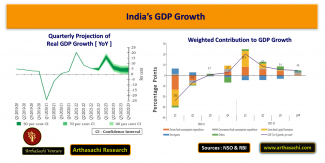

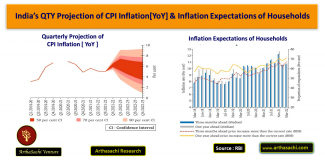

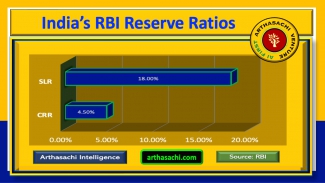

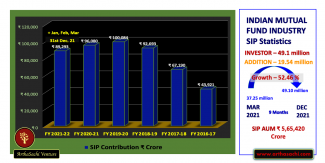

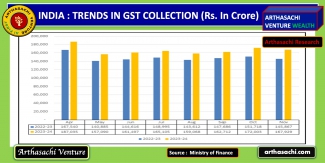

Indian Economy Indicators [ Arthasachi Research ]

India’s Robust Economy Fuels Records Highest Growth rate of 15% YoY in November GST Revenue collection

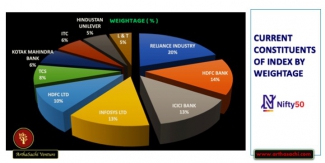

Market Statisctics [ NSE ]

| Particular | Data |

|---|---|

| Traded Value (Rs. In Crores) | 135,527 |

| Traded Quantity (in Lakhs) | 64,294 |

| Number of Trades | 39,590,271 |

| Total Market Capitalisation (Rs. Crores) | 46,734,590 |

| ADVANCES | 2,176 |

| DECLINES | 1,039 |

| UNCHANGED | 84 |

| Total securities (hit their price bands) | 182 |

MOST ACTIVE [ NSE ]

| Company | Prev. Price | Close Price | Change % | Value ( Rs Crs ) |

|---|---|---|---|---|

| SILVERBEES | 247.34 | 265.57 | 7.37 | 4,554.17 |

| INFY | 1,656.00 | 1,535.80 | -7.26 | 4,437.80 |

| TCS | 3,225.30 | 2,999.10 | -7.01 | 3,278.09 |

| HDFCBANK | 948.70 | 953.10 | 0.46 | 2,321.94 |

| HAL | 4,470.40 | 4,217.10 | -5.67 | 2,229.85 |

| HINDCOPPER | 614.75 | 613.65 | -0.18 | 2,198.11 |

| GOLDBEES | 125.20 | 129.60 | 3.51 | 2,070.10 |

| ETERNAL | 279.80 | 294.15 | 5.13 | 1,883.99 |

| DIXON | 11,031.00 | 11,678.00 | 5.87 | 1,738.34 |

TOP GAINERS [NIFTY 50]

| Company | Prev. Price | Price | Gain % |

|---|---|---|---|

| ETERNAL | 279.80 | 294.15 | 5.13 |

| TRENT | 3,822.80 | 4,012.60 | 4.96 |

| ONGC | 257.00 | 266.95 | 3.87 |

| NTPC | 358.55 | 367.25 | 2.43 |

| ADANIPORTS | 1,530.80 | 1,567.90 | 2.42 |

TOP LOSERS [NIFTY 50]

| Company | Prev. Price | Price | Loss % |

|---|---|---|---|

| INFY | 1,656.00 | 1,535.80 | -7.26 |

| TCS | 3,225.30 | 2,999.10 | -7.01 |

| HCLTECH | 1,695.30 | 1,621.80 | -4.34 |

| TECHM | 1,716.50 | 1,645.30 | -4.15 |

| WIPRO | 242.69 | 233.34 | -3.85 |

NSE Sectorial Indices

| Indices | Prev. Close | OPEN | HIGH | LOW | Price | Change | Change % |

|---|---|---|---|---|---|---|---|

| Nifty 50 | 25,727.55 | 25,675.05 | 25,818.55 | 25,563.95 | 25,776.00 | 48.45 | 0.19 |

| NIFTY50 EQL Wgt | 33,177.70 | 33,126.95 | 33,381.70 | 32,952.05 | 33,327.25 | 149.55 | 0.45 |

| NIFTY100 EQL Wgt | 33,722.95 | 33,716.35 | 33,966.70 | 33,451.85 | 33,927.10 | 204.15 | 0.61 |

| NIFTY100 LowVol30 | 20,685.55 | 20,632.35 | 20,744.40 | 20,532.40 | 20,669.00 | -16.55 | -0.08 |

| NIFTY Alpha 50 | 49,078.85 | 49,182.00 | 49,642.90 | 48,937.10 | 49,566.60 | 487.75 | 0.99 |

| NIFTY MIDCAP 150 | 21,869.85 | 21,852.05 | 22,023.05 | 21,699.45 | 22,002.00 | 132.15 | 0.60 |

| NIFTY SMLCAP 50 | 8,268.15 | 8,273.35 | 8,425.70 | 8,245.15 | 8,411.10 | 142.95 | 1.73 |

| NIFTY SMLCAP 250 | 15,962.45 | 15,950.40 | 16,104.60 | 15,877.40 | 16,084.15 | 121.70 | 0.76 |

| NIFTY MIDSML 400 | 19,674.70 | 19,659.05 | 19,821.50 | 19,538.85 | 19,804.05 | 129.35 | 0.66 |

| NIFTY200 QUALTY30 | 21,121.90 | 20,957.15 | 20,995.10 | 20,737.10 | 20,946.40 | -175.50 | -0.83 |

| Nifty FinSrv25 50 | 30,192.30 | 30,241.75 | 30,511.80 | 30,108.60 | 30,444.60 | 252.30 | 0.84 |

| NIFTY AlphaLowVol | 26,607.85 | 26,645.00 | 26,849.05 | 26,536.45 | 26,802.05 | 194.20 | 0.73 |

| Nifty200Momentm30 | 30,630.95 | 30,688.45 | 30,987.00 | 30,496.55 | 30,926.05 | 295.10 | 0.96 |

| Nifty100ESGSecLdr | 4,299.40 | 4,286.70 | 4,313.80 | 4,263.10 | 4,308.00 | 8.60 | 0.20 |

| NIFTY100 ESG | 5,154.60 | 5,135.50 | 5,163.60 | 5,095.60 | 5,157.05 | 2.45 | 0.05 |

| NIFTY M150 QLTY50 | 23,715.55 | 23,611.35 | 23,798.35 | 23,392.50 | 23,778.35 | 62.80 | 0.26 |

| NIFTY INDIA MFG | 15,381.10 | 15,408.85 | 15,552.20 | 15,321.60 | 15,509.35 | 128.25 | 0.83 |

| Nifty200 Alpha 30 | 24,670.25 | 24,722.05 | 24,909.75 | 24,553.90 | 24,858.65 | 188.40 | 0.76 |

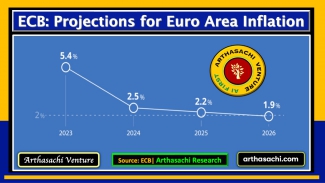

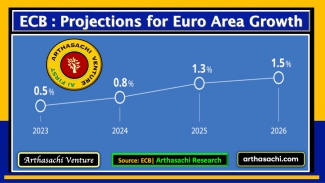

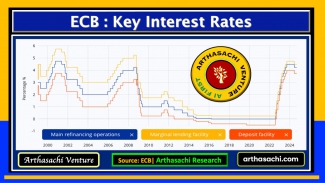

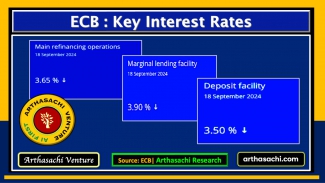

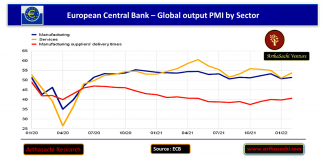

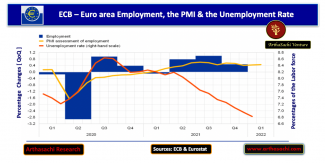

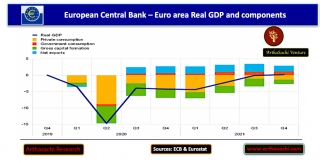

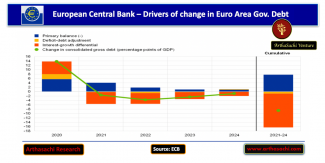

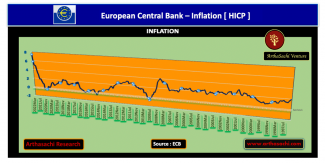

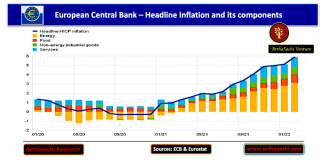

European Union (EU) Economy Indicators [ Arthasachi Research ]

ASIA NEWS

EUROPE NEWS

AMERICA NEWS

Arthasachi Venture Footprints

![India’s Automobile Sector Indicators [ Rural Demand ]](/sites/default/files/styles/max_325x325/public/2022-04/India%E2%80%99s%20Automobile%20Sector%20Indicators%20Rural%20Demand.png?itok=DmK8MlAC)