Markets News

EARNINGS

Commodities News

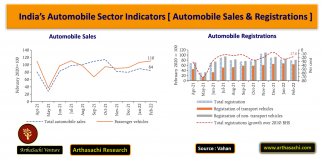

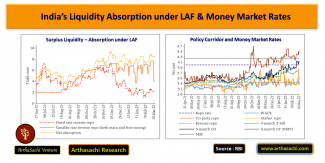

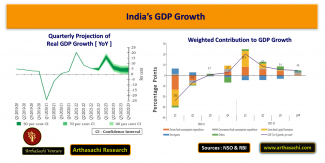

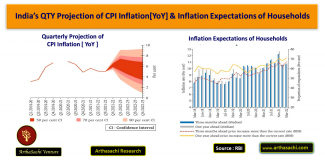

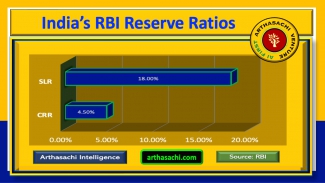

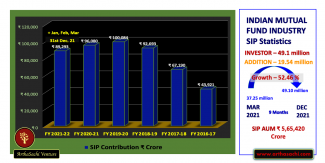

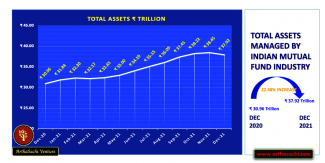

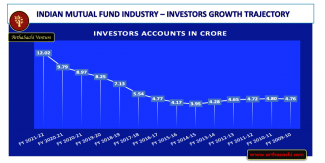

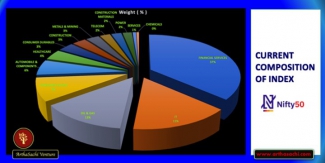

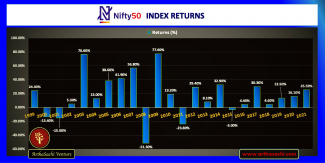

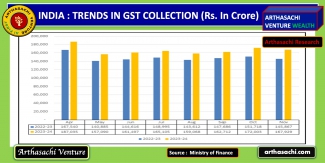

Indian Economy Indicators [ Arthasachi Research ]

India’s Robust Economy Fuels Records Highest Growth rate of 15% YoY in November GST Revenue collection

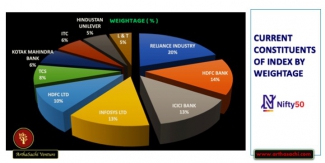

Market Statisctics [ NSE ]

| Particular | Data |

|---|---|

| Traded Value (Rs. In Crores) | 135,527 |

| Traded Quantity (in Lakhs) | 64,294 |

| Number of Trades | 39,590,271 |

| Total Market Capitalisation (Rs. Crores) | 46,734,590 |

| ADVANCES | 2,176 |

| DECLINES | 1,039 |

| UNCHANGED | 84 |

| Total securities (hit their price bands) | 182 |

MOST ACTIVE [ NSE ]

TOP GAINERS [NIFTY 50]

| Company | Prev. Price | Price | Gain % |

|---|---|---|---|

| ETERNAL | 279.80 | 294.15 | 5.13 |

| TRENT | 3,822.80 | 4,012.60 | 4.96 |

| ONGC | 257.00 | 266.95 | 3.87 |

| NTPC | 358.55 | 367.25 | 2.43 |

| ADANIPORTS | 1,530.80 | 1,567.90 | 2.42 |

TOP LOSERS [NIFTY 50]

| Company | Prev. Price | Price | Loss % |

|---|---|---|---|

| INFY | 1,656.00 | 1,535.80 | -7.26 |

| TCS | 3,225.30 | 2,999.10 | -7.01 |

| HCLTECH | 1,695.30 | 1,621.80 | -4.34 |

| TECHM | 1,716.50 | 1,645.30 | -4.15 |

| WIPRO | 242.69 | 233.34 | -3.85 |

NSE Sectorial Indices

| Indices | Prev. Close | OPEN | HIGH | LOW | Price | Change | Change % |

|---|---|---|---|---|---|---|---|

| Nifty SME Emerge | 13,098.85 | 13,144.55 | 13,144.55 | 13,066.85 | 13,119.35 | 20.50 | 0.16 |

| Nifty Internet | 1,289.95 | 1,287.70 | 1,301.70 | 1,267.15 | 1,298.75 | 8.80 | 0.68 |

| Nifty Chemicals | 28,378.05 | 28,388.20 | 28,595.25 | 28,269.05 | 28,534.70 | 156.65 | 0.55 |

| Nifty Waves | 1,926.65 | 1,932.55 | 1,964.25 | 1,920.95 | 1,957.95 | 31.30 | 1.62 |

| Nifty InfraLog | 11,291.50 | 11,303.35 | 11,434.80 | 11,216.40 | 11,426.25 | 134.75 | 1.19 |

| Nifty500 Health | 18,065.05 | 18,083.90 | 18,127.65 | 17,930.95 | 18,025.50 | -39.55 | -0.22 |

| India VIX | 12.90 | 12.90 | 13.15 | 12.06 | 12.25 | -0.64 | -4.98 |

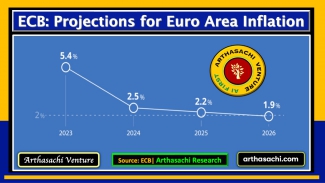

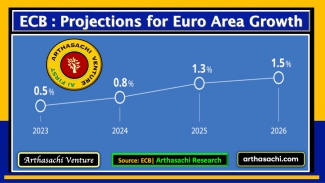

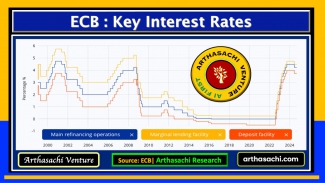

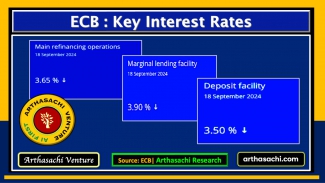

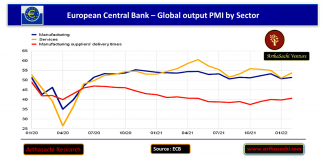

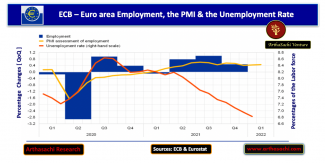

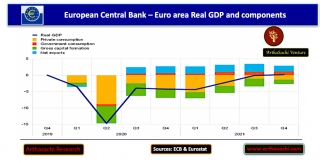

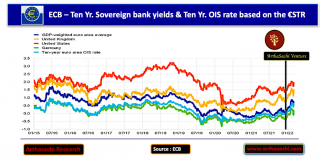

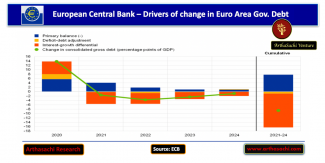

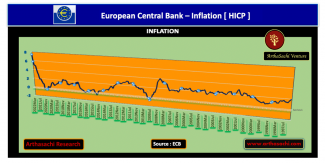

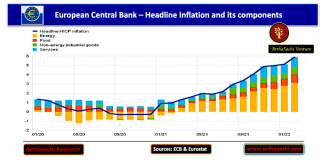

European Union (EU) Economy Indicators [ Arthasachi Research ]

ASIA NEWS

EUROPE NEWS

AMERICA NEWS

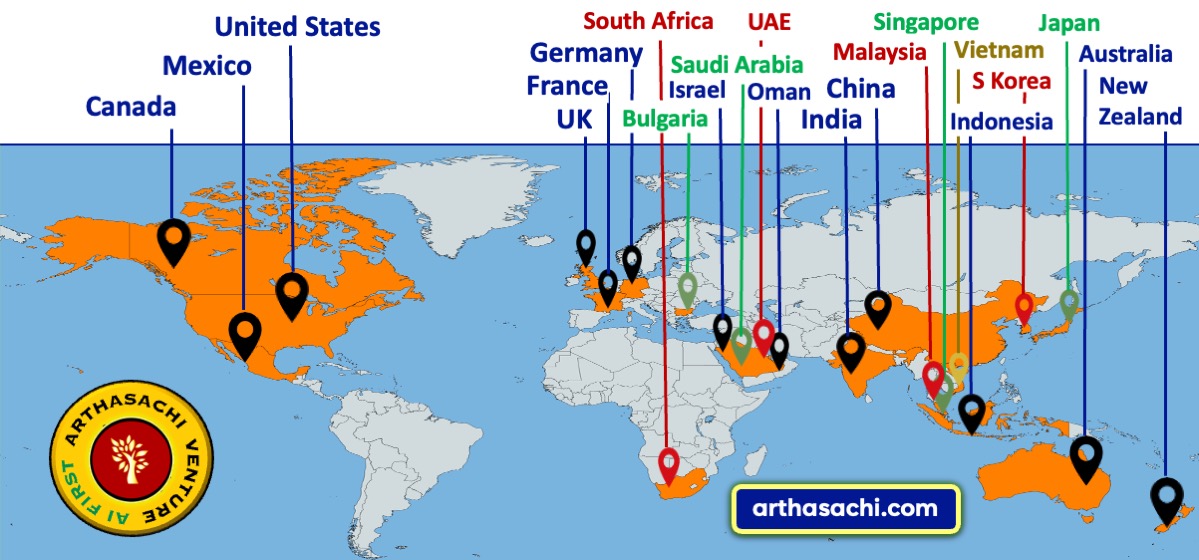

Arthasachi Venture Footprints

![India’s Automobile Sector Indicators [ Rural Demand ]](/sites/default/files/styles/max_325x325/public/2022-04/India%E2%80%99s%20Automobile%20Sector%20Indicators%20Rural%20Demand.png?itok=DmK8MlAC)